Apr 12, 2013

Whew.. Mrs. MM and I finally signed, sealed and delivered both our income and property taxes earlier this week. Since I hadn’t made enough estimated tax payments on self employment income through the year*, it ended up being a pretty big bill. But it is done for another year, which is a fine feeling. This…

It’s time to dive in and explore some interesting new investment options. I have some personal cash set aside, and the newly-minted Money Mustache Foundation has $10,000 of seed capital that we’d also like to put to work. On top of this, I have replaced the old $75,000 line of credit on my primary house…

Almost two years ago, I started getting reader emails asking me if student loan refinancing was a good idea, and if a company called SoFi was a good place to do it. Never having carried such a loan myself I wasn’t sure if I was qualified to answer, but other emails were coming in reporting…

I’ve always been a do-it-yourself investor. This habit started around age 19 with a series of ridiculous speculative trades in individual high-tech company stocks. “This stock is sure to go through the roof”, I would think, “because their products are so great.” This is a terrible way to invest. But after a few early financial…

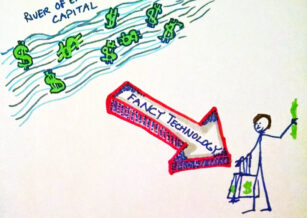

The good news is, we sold our old house shortly after moving into the new one. The bad news is that the net proceeds (just over $400,000 after all related costs) are on the way to the bank account, where they will immediately become a sea of donut-munching, water-cooler-gossiping Idle Employees doing no useful work…

With over 500 articles published as of 2020 and still going, this has become a huge blog. But some people allege that it’s a good one, and thus they want to read as many of those posts as they can. In the olden days, that meant going to the first post, and reading and navigating…

It has now been a whole year since the MMM family made the jump to a low cost / high-deductible health insurance plan, so I figured it would be useful to provide an update on how the year has gone. The one we ended up with was called the “Saver80”, a barebones but useful plan…

In the quest to become wealthy on a finite income, your savings rate dominates all other factors. Because of that, this blog tends to fixate on living happily and efficiently, and the oddly magical lifestyle changes that allow you to drop your spending dramatically even while improving every area of your life. However, this can…

On May 13th of this year, I had the chance to log in to a special chitchat system hosted by the Washington Post, and field a bunch of live questions from their readers in response to the interview I had done with that paper’s business section a few days earlier. I found this to be great…

Ahh, Financial Media. It is a key cog in today’s ever-churning news machine, because hey, who isn’t interested in money? Everyone has a go at it, from the tanning-salon-smile hosts of the regional news shows reporting the daily close of the Dow index, up to the Ph.D. credentialed economists who debate economic indicators and fiscal…

Well, the Mustache Family is home at last. We touched down in Colorado yesterday morning after an uneventful flight. I learned that United Airlines now makes their attendants shriek a brief advertisement or two into the cabin microphone before letting people settle in – this time was an encouragement to do some shopping in…

Unfortunately for me, one of the concepts I find most annoying to read about happens to be one of those the mainstream financial media likes to write about the most: The hard times that have befallen Hardworking Americans*, and how it is entirely the fault of the system in which we are all stuck. Depending on…

Want to hear something really weird? All this time, I’ve been writing this blog about financial independence, a term and movement that is often credited to the 1993 book “Your Money or Your Life”. I had been assuming that Mr. Money Mustache himself was at least partly motivated by a long-ago reading of that book…