Sep 4, 2011

Mrs. Money Mustache forwarded to me an interesting video clip on YouTube with this wise old guy dishing out some very humble and sensible lessons for living a meaningful life. As I watched, I came to realize the guy talking was John Bogle, the founder of the Vanguard Group, a place that has been leading…

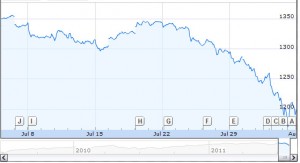

Stock market watchers like myself have had an entertaining couple of weeks recently. Amid lots of dramatic economic and political news, the S&P 500 index has dropped from a July level of 1356 down to 1199 (as of Friday August 5th). This 157-point drop works out to almost 12 percent of the value of the…

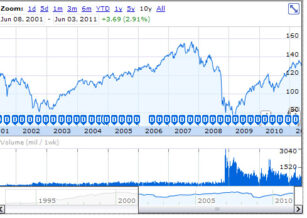

In most of my examples of small savings adding up over time, I assume that you the saver are not only saving the money, but investing it for some compounding gains. For example, I once stated that saving $25 per week by skipping a restaurant meal adds up to about $19200 after 10 years. To…

We’re diving into a fundamentally new field here – the field of actually increasing your income, which is quite different from the cutting your spending I usually advocate. For most people, the cutting works much better because they already have a shortage of free time, and a surplus of income compared to what is actually…

Being a newcomer to the financial guru circle, Mr. Money Mustache decided to check out what his competitors have been saying throughout historical times to see if they have their stories straight. So he spent a recent weekend listening, in full, to the audio book version of Dave Ramsey’s ultimate career work: the Total Money…

Okay, admittedly my title for this article sounds like something that you might see in your Spam folder. But it’s also completely accurate, because I really can teach you the best way to make money from the stock market, for life, all in one short blog post. Okay, I admit it – this is widely…

I was recently enjoying a conversation with a new friend. Despite my best efforts to sound normal and busy, this person eventually figured out that my wife and I don’t actually do enough paid work to sustain the normal middle-class life we seem to lead. From here he pried out the fact that I am…

I think the main reason people seem amazed at the idea of retiring at age 30, 40, or even 50 is the lack of real information on early retirement in general. If you type “retirement calculator” into a search engine these days, and enter some basic stats about yourself, you will find some very strange…

Hi, It’s me the Realist again. I think I’ve noticed a pattern with Mr. Money Mustache. He is part of what I like to call, “The Religiously Frugal”. For him, the avoidance of spending is not just a way of reaching a goal… the frugality itself is the goal. He actually likes this shit! If you…