For a little over ten years, I have been contributing to an automated stock investing account, choosing Betterment out of a large and growing field of companies (affectionately referred to as Robo Advisers) that offer similar services.

See Article: Why I Put My Last $100,000 into Betterment

On this page, I’ll keep you up to date with quarterly results, and we’ll also learn more about how Betterment works, and investing in general.

Show Me The Money!

(results as of May 2025 – including dividend reinvestment and after fees)

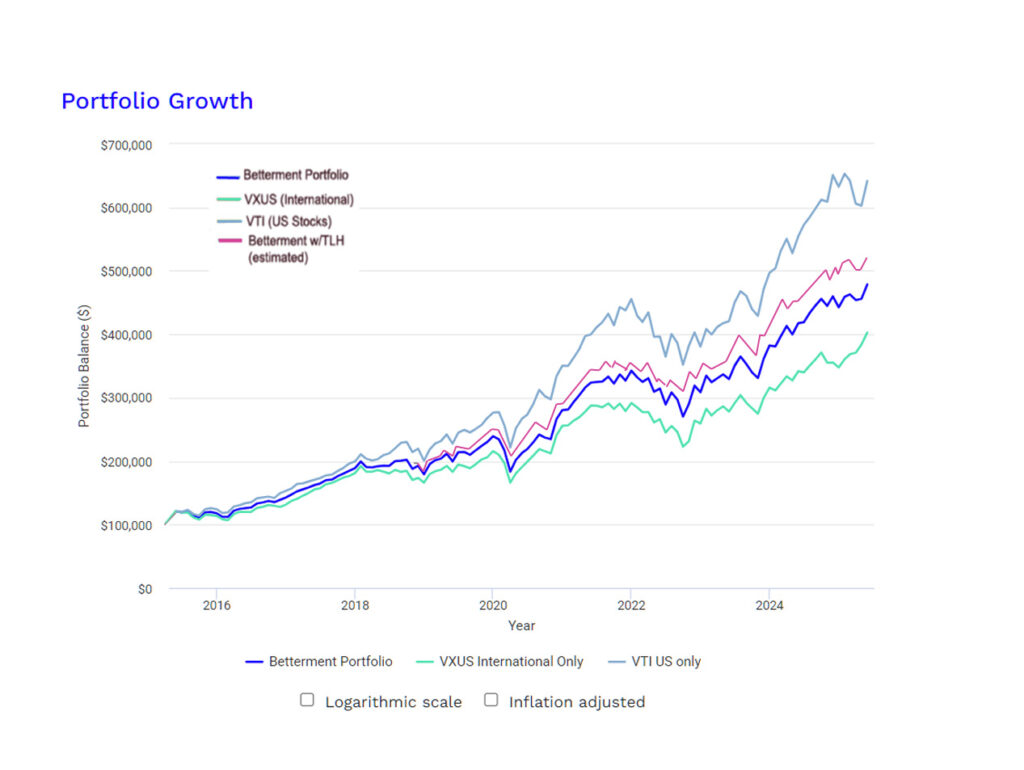

The blue line in this handy graph shows the results of my real investment at Betterment. I started with $100,000*, and am allowing them to suck in and auto-invest another $1000 from my bank account every month as well as reinvest all dividends, to simulate a pretty typical scenario.

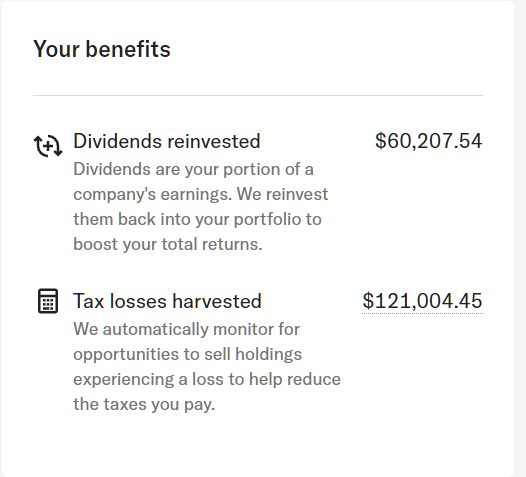

The purple line is my best estimate of my own benefits from Betterment’s tax loss harvesting feature. That depends on your own individual tax situation, but so far I have seen over $121,000 of “tax losses” harvested from this account, which at a marginal tax rate of 40% (state+federal) has added over $48,000 of benefit to my account value which compounds over time (see below), which would bring that line much closer to the top.

The top (grey) line is what would have happened if I had followed the same investment pattern with entirely US stocks through Vanguard’s excellent VTI Exchange-traded fund, and the bottom line is the same scenario if I had bought Vanguard’s equally excellent “Everything Except the US” fund, which goes by the ticker symbol VXUS.

This should help put the 2018, 2020 and 2022-2023 market declines into perspective, which all generated a lot of scary headlines in the financial papers involving the words “plunge” and “worst ever”. This is because newspapers make money off of scaring you, while in fact there is nothing scary at all about a buy-and-hold index fund investment.

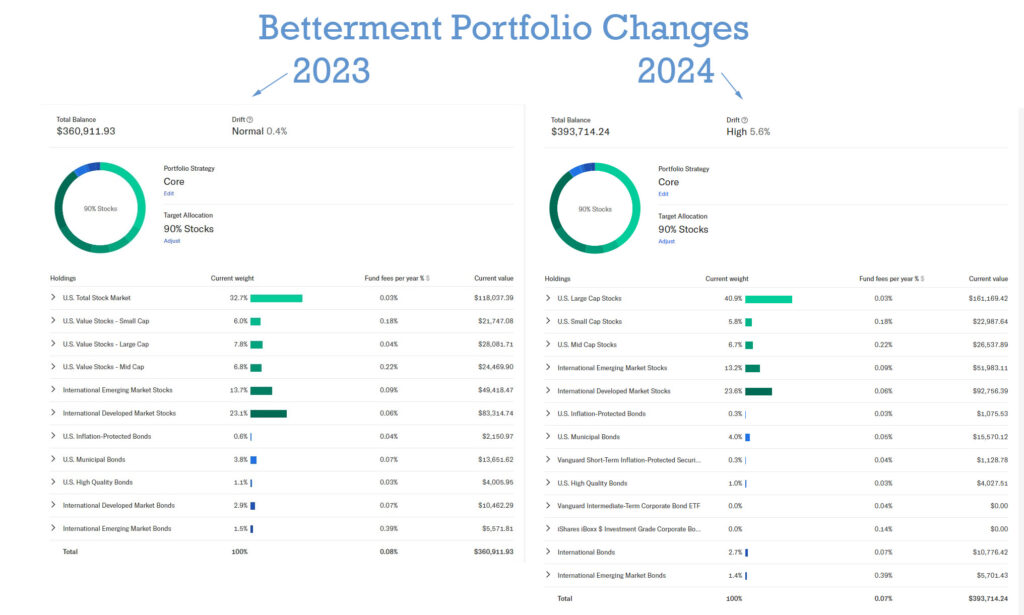

New in 2024: Betterment (slightly) Tweaks the Portfolio

Over these first ten years, the Betterment portfolio has fought an interesting battle: US mega cap stocks (like Apple and NVidia) have gone crazy and outperformed both the rest of our economy, and the rest of the world. Meanwhile, bonds have had a slow decade, due to low interest rates. This has handicapped the Betterment allocation relative to a hypothetical helping of purely US stocks. Fighting these macroeconomic trends on the positive side, Betterment’s tax loss harvesting and rebalancing has partially made up some of the difference (see below for details on that harvesting).

In January of 2024, Betterment made a slight change to their default portfolio, going a bit more all-in on the pure US index and reducing the “value tilt”. Here’s a screenshot of my account’s allocation before and after this change (click for full image):

I also spoke with some of Betterment’s investment management team after this change, who explained some of the other benefits of the new allocation. In short, not only does it bring the portfolio back into line with their original investing goals, but a drop in underlying fund expense ratios also allows for even better potential tax loss harvesting in the future.

Moving back to our regular programming, here’s my account’s performance since the beginning:

A recent screenshot of my “performance” tab. Note that I took out $95k for a charitable donation in late 2020, then replaced exactly the same number of shares when I had the cash in September 2021 (by that time the same shares cost me $135k – another great illustration of why you should always stay invested!)

Why do I think this is a good strategy?

In one word: Simplicity. OK, maybe we could add a second word to that: Efficiency.

After twelve years of writing this blog and hearing from readers of all types, I find that the same question keeps coming up: “What is the single step I can do to get started in investing?”

With no knowledge at all, most people default to keeping their money in a savings account where it will earn them nothing. Others resort to a Wild West financial adviser whose claims and fees exceed his actual financial knowledge. Or speculate in individual stocks and try to time the market. None of these approaches are winners over the long run.

To combat this, I’ve always said “Just buy the Vanguard Total Market Index fund (ticker symbol VTI).” That gives you a near-optimal ownership of hundreds of companies, in single giant, stable, low-fee fund run by an honest company. Over time, this single investment will outperform over 90% of financial advisers and other funds, while letting you sleep well at night.

To improve on VTI, you need to soak up a few more books about investing, general world finance, and asset allocation. And while this has always been my idea of a good time, I have learned that many people have other ideas for their weekends. And even those of us who read these investing books (myself included) often fail to execute the principles properly and consistently.

Betterment combines the (slight) advantages of more advanced investing, with an even simpler experience than you would get with just buying shares of VTI. The worthwhile things they provide, in my opinion, are:

- tax loss harvesting (see below)

- automatic tax-saving coordination between your standard and retirement accounts with Betterment

- really good tools to show you things like, “how much tax would I owe if I sold these shares right now?”, “how much income would my portfolio generate if I retired right now?”, and other useful visualizations

- a very sleek charitable giving system, which makes it easy to donate some of your appreciated shares – giving you a much bigger tax advantage than simply giving cash. More details on this in my 2017 charitable giving article.

In exchange, they charge a fee of 0.25% that is higher than just holding individual index funds, but much lower than standard financial advisors – and yet their investment methods are better than the average advisor, because many of them are commission-based, meaning they make money by steering you towards certain funds).

So in my view, Robo-advisors are a good way to invest for people who want things to run on autopilot.

Hey, my Betterment account [underperformed or overperformed] the US stock market! Why?

Welcome to your first two lessons on investing:

- Short-term fluctuations (under 10 years) mean almost nothing.

When investing for lifetime wealth, you need to think about longer time periods than you’re used to. It doesn’t matter what your stock does right after you buy it. What matters is the average price as you sell it off in increments much later in life – which could be 20-80 years from now. For example: Imagine that I went back in time to October 2014, but instead of getting started with Betterment, I bought $100,000 of stock in the video game company Electronic Arts (EA). As luck would have it, those shares would have closed out 2014 worth about $143,000. Does that mean EA is a better investment than VTI? No, it’s just more volatile. In fact, if you had bought EA in 2003 and walked away until December 2015, you would have earned zero returns for the entire twelve year period. The company has never even paid a dividend. Individual stocks are more volatile than the overall index, and yet collectively their returns equal that of the index. Which is a bad tradeoff in my opinion. - Your fancy new Betterment account contains more than just US stocks – over the long run this is a good thing!

The Vanguard fund VTI tracks the majority of US stocks. A Betterment portfolio tracks the majority of the developed world’s stocks. In recent years, the US S&P 500 index has been on a rampage, although mainly because of crazy overperformance of only the biggest and most heavily weighted stocks (Apple, Microsoft, Amazon, Google, Nvidia, Facebook, etc). And meanwhile, most European companies have seen solid earnings but lower stock price multiples. In other words, European stocks have been on sale. So my Betterment portfolio didn’t rise as quickly as the US market. At other times, the reverse happens: US stocks will fall dramatically, while other markets will fall less or even rise. On top of this, international stocks currently pay a much higher dividend yield. For every $100,000 of VTI you own, you’ll get about $1600 in annual dividends. For an equal amount of VXUS, you will get $2880, or almost twice as much. In other words, international stocks are priced at a much more attractive level than US stocks, which in my book is a time to buy.

How about that Tax Loss Harvesting?

One of the features of Betterment is that their computers spend all day looking at the stock market while you are off doing other things. Occasionally, this leads to an opportunity to profit from volatility in the market. Selling some of your stuff to lock in a tax-deductible loss, while buying very similar stuff through other funds so you remain fully invested.

Since I started this account, I have found that this feature works much better than I had expected. Take a look at this recent snapshot from my account :

Betterment has harvested a surprising $121,004 in deductible “losses” on an account with about $466k of taxable money in it.

The value of this is significant: a $121k deduction has saved me over $48,000 in income taxes already, which I have used to buy still more investments. If this $47,000 goes on to earn a conservative 7% ($3300/year), it is more than paying for the fees Betterment charges me (0.25% of $460,000 is over $1000 per year). Forever. And that’s just the passive income from these early years of tax loss harvesting. Then you also get to keep the principal you saved from the loss harvesting.

In other words, in my opinion Betterment costs less than nothing to use due to TLH alone, even before you factor in the benefits of the automatic reallocation, better interface, or other features.

The bottom line is that you save on taxes today but end up with investments which have a lower cost basis. This means you’ll have more taxable gains when you eventually sell them But for many of us, this is years down the road in retirement when we have ditched the full-time salary and thus are in a lower tax bracket.

How this works in practice: So when I file taxes for each year, I can take the Tax Loss Harvesting numbers from Betterment, and chop that amount off of any capital gains I made elsewhere that year. Sometimes those include profits from selling a rental house, or shares pf regular stocks that I sold to buy a new house, or up to $3000 against ordinary income. Betterment sends you a tax statement that you simply plug into your IRS tax forms, Turbo Tax, or hand to your accountant.

But this is not useful for everyone. For example:

- If you are using Betterment for an IRA rather than a taxable account, there is no such thing as Tax Loss Harvesting.

- If you are in a low income tax bracket right now, you might not have enough potential tax savings to make it worthwhile

- If your income ends up rising even after retirement (as has happened to me and many other early retirees), TLH might be counterproductive if you still have super-high income in the years that you are cashing out your Betterment account. (talk about Champagne Problems!)

- If you have other investments outside of Betterment with similar or identical funds, you might find the IRS disallows Betterment’s harvested losses. To prevent this, I hold different funds in my other accounts (I use Vanguard’s ESGV index fund instead of VTI – similar but different enough to avoid the risk of a wash sale)

Even with the caveats above, it is a cool enough feature – and profitable for many – that I left it enabled since the beginning.

This experiment remains interesting even after quite a few years, so I look forward to years of profits and analysis to come!

Note: To be clear on the background, I did not get paid to write this or any other post, but Betterment does advertise on this site. See the affiliates policy if you’re curious how I handle blog income.

* I chose an allocation of 90% stocks, 10% bonds, which you do by moving a simple slider control on the Betterment website as you set up your account.

Useful Resources:

The price and dividend payment history of VXUS and VTI, which I used to generate the spreadsheet to make the graph above:

http://www.nasdaq.com/symbol/vxus/historical

http://www.nasdaq.com/symbol/vti/historical

Portfolio Visualizer, a stock market analysis tool I really like, which I use to generate the comparison graph each time I update this article.

Neil January 13, 2015, 8:35 am

Betterment seems like an excellent way to ease into investing. Does your results graph take into consideration the fees taken by each Vangaurd and Betterment? Betterment’s are higher than Vanguard but still very reasonable. Looking forward to seeing this drama unfold!

Mr. Money Mustache January 16, 2015, 4:58 pm

Hi Neil, great question. Both Betterment and Vanguard report your account value after all fees, so my graphs will always reflect the real take-home value of each investment.

Dividend Growth Investor May 8, 2015, 9:04 am

MMM,

I liked you even more when you said this :

” For every $100,000 of VTI you own, you’ll get $1780 in annual dividends. For an equal amount of VXUS, you will get $3370, or almost twice as much. ”

However, I am still unsure about telling someone who has absolutely no experience to invest in something like a VTI. It’s not a bad choice, but the only concern is that absolutely new investors can get scared way even from a small amount of volatility. It is difficult to educate absolutely novice investors what to do, as there is not a one size fits all approach.

Krys September 10, 2016, 9:15 pm

I’m a brand new investor ready to drop my first small amount of money, debating Vanguard and Betterment. My problem isn’t the ability to ride volatility.. I’m super okay with that. Like, I have no problem seeing the 40 year trends of what’s been happening with stock markets, and over time, see a surplus. My scares come from not knowing how to manage these Vanguard funds. Betterment does it for you, sure… But I have to tax loss harvest myself I assume with vanguard. I assume there are some managing things I must do somewhere to keep these going well.. Everyone says you gotta read up on how, and no information I read seems to say exactly how, so I’m stuck worried that I’ll throw money at Vanguard and not know what I’m doing to keep it going afterwards.. Ideally, I’d like to throw money at both, but I can only choose one for right now to start investing in.. I’m not scared of letting stocks ride for the long haul or scared of throwing more money into it month to month, but I am scared of what to do year-to-year with stocks that I already own while they’re doing their thing. I have no clue how to let those dividends mature and care for them.

Austin July 31, 2017, 6:31 am

Hey Krys,

Way late to this but check out Robinhood. They’re a fee-free investing platform and make it pretty easy. I have their app. I have money in it to play with, but haven’t committed it to anything yet. I checked, and they have VTI and VXUS listed. I don’t know what it’s like filing taxes with them, like I said I haven’t used them yet.

Cory August 13, 2017, 9:20 pm

Hi Austin,

Even though Robinhood is an investing platform that allows you to trade for free there are still a lot of people out there who don’t know exactly what to trade in. It can be a little overwhelming.

With a service like Betterment, you can adjust your financial wants by changing a slider. No need to go picking stocks and hoping for the best.

Teresa January 8, 2020, 9:02 am

Hi Krys! Did you ever end up finding what you needed and choosing? I have been stuck in this exact place for THREE years, and I would love to know if you found the answers you were looking for.

Kelly Mitchell April 22, 2020, 12:33 pm

I’ve been looking at dividend investing and have a few. But imo, there is a much better way, at least to get in. Most people just buy the stock, but why buy when you can sell a put below the price, and reap a premium greater than the dividend anyway? Sure, you give up the price increase, but you avoid the price decline unless it’s below your strike price minus put premium. Moreover, you cough up only 20% margin for a naked put.

Jorge April 17, 2016, 2:55 pm

Dear MMM,

I have been pouring over the calculations, and probably spending more time than I should, but I want to make sure I am partnering with the best investment service, since I plan on setting up this thing once, and not messing with it too much in the future. A lazy portfolio approach, if you will.

I don’t doubt that the Tax Loss Harvesting option is a nice feature that can produce measurable savings. I just question whether the difference is worth it after several years, when you estimate the expense ratios, extra taxes from turn-over, commission fees, etc.

Please take a look at these 3 portfolios. I compared the current Aggressive mixes from Betterment, Wealthfront, and a single mutual fund from Vanguard (my personal rock star, VTSAX)

https://www.portfoliovisualizer.com/backtest-portfolio?s=y&allocation4_1=5&endDate=04%2F16%2F2016&allocation2_1=18&symbol5=VEA&symbol4=VBR&allocation8_2=5&lastMonth=12&allocation6_1=13&symbol7=VIG&symbol6=VWO&allocation6_2=28&symbol1=VTI&endYear=2016&symbol3=VOE&frequency=4&symbol2=VTV&inflationAdjusted=true&annualAdjustment=30000&showYield=false&symbol10=VTSAX&startYear=1985&symbol9=MUB&symbol8=XLE&allocation10_3=100&rebalanceType=1&timePeriod=4&annualPercentage=4.0&allocation1_1=18&allocation5_1=41&allocation1_2=35&allocation3_1=5&allocation7_2=5&allocation5_2=22&allocation9_2=5&annualOperation=3&firstMonth=1&reinvestDividends=true&initialAmount=1000000

As you can see, the single Vanguard fund blows the other two out of the water after only a few years, no contest. Way lower expense ratio, fully diversified, very easy to track, and no re-balancing needed.

One thing I like about Vanguard very much, is that you can have all your accounts managed within a single interface, with a highly reputable company, where you can setup a spending account with ATM withdraws, where all the dividends and proceeds can be automatically swept according to your own schedule. Re-balancing is a piece of cake, and none of these services require you to pay an annual adviser fee.

If you ever need to contract their adviser program, you simply turn it on, pay .30 basis points, and you get the same level of service, or higher, than the other guys. When you want to turn the adviser part off, you simply turn it off. To turn off the adviser service with Betterment or Wealthfront, you would have to move your money somewhere else.

The only draw back I see is that Vanguard does not currently offer Tax Loss Harvesting, but I suppose a person could do a hybrid approach, sending $100k or so to a Wealthfront taxable account, to get their superior Direct Indexing service, and leave all the tax-advantaged money with Vanguard. At least that is the way I am leaning.

What are your thoughts on this?

Thanks!

Jorge April 17, 2016, 3:22 pm

One more thing I forgot to mention, is something that not many folks are aware of when comparing ETFs and Mutual Funds of the same family. Even though both may be from the same company, have the same expense ratio, and track the same exact index, the big difference over time is the bid/ask spread on ETFs. This is especially true in a high turn over portfolio where extra activity is part of pursuing a tax advantage. Those spreads can add up to very significant differences over time.

Mr. Money Mustache April 18, 2016, 9:56 am

Hey Jorge – first of all, portfoliovisualizer looks like a GREAT tool, thanks for sharing it!

Secondly, in the link you gave, the analysis period gets truncated from 2008 to present, which I’m sure you would agree is not a good representation of average market performance. The problem seems to be some of the funds are more recently created.

If you can substitute some longer-lived equivalents and have the backtesting go from, say 1974 to present it might be a better test. But backtesting is a tricky game to play no matter what: you can always find a range of dates to prove almost any hypothesis.

I personally just happen to believe the Betterment asset mix is a preferable one to just US equities. But I could be wrong: if we end up with better governments than Europe over the long term, it’s possible we’d continue to dominate for a long time.

Jorge April 19, 2016, 7:47 pm

Yeah, I noticed also that it truncated from 2008. That is because of one or more of the underlying ETFs was not in existence back then, so it chops the entire portfolio at that point.

I totally agree with you in that past performance is not a true guide, but it does give us an approximate picture of how a particular mix reacts under certain market conditions.

As far as the robo-advisers, or any other type of adviser for that matter, maybe it is my extra frugal nature that tells me there must be a better way to get automation without dishing out so much cash.

When I do the math on an extra annual expense of .25 for the service, on top of the more expensive ratios for regular Investor-class ETFs, compared to the Admiral shares I have in my mix, that is a pretty substantial amount of cash going out the door every year. I mean, we are talking about an extra .35 to .50 on the average, and that doesn’t even include the extra drag produced by the bid/ask spreads.

Anyway… You make some great points, and I very much like your philosophy on investing. I want you to know that you have been a huge inspiration for me, ever since I found your web site just a few months ago. I had not explored the possibility that I could actually pull the plug earlier than the establishment dictates, but after running the numbers, I think I can, I know I can, I’m sure I can. :-)

Thanks so much for being a voice of reason out there MMM.

Moneycle April 18, 2016, 3:25 pm

Jorge, Portfolio Visualizer is cool. Thanks for sharing. Just a word of warning to users following this thread, the link that shows up in the emailed post doesn’t work correctly. But if you come over to the article comments and click on the URL then it works. (All the ampersands were escaped to & which messes up the URL)

Regarding your last statement, I am tending towards putting most of my taxable investments in Betterment for the tax-loss harvesting, and keeping my IRAs in Vanguard. This seems like a good approach. Also, Betterment has some pretty nice tools for helping with drawdown on a portfolio which are nice once you hit retirement.

Jorge April 19, 2016, 8:10 pm

Moneycle,

Thanks for the heads-up, and sorry I didn’t anticipate the encoding messing up the link.

I personally think that stashing part of a person’s taxable assets with Betterment, Wealthfront, or a similar service, is a good plan. I’m contemplating adding $100k to a taxable account with Wealthfront to see how their Direct Indexing performs. They manage the first $15k for free, so I only pay .25 on the remaining $85k ($212), and that qualifies me for the Direct Indexing service, which they claim it is way better than indexing on whole ETFs. We’ll see.

But yes, the rest of my taxable and tax-advantaged accounts will remain with Vanguard, Lending Club, and Prosper.

BTW, for retirement funds with Vanguard, check out VWIAX. A real beauty in terms of the reward to risk ratio, even though it only has less than 40% stocks in the mix. Pretty impressive returns given the stability and low risk.

Cheers!

Josh G August 24, 2016, 7:03 am

Does anyone here have experience with Wealthfront’s direct indexing and how much it saves on fees? I’m trying to decide whether to open a $100K taxable account at Betterment or Wealthfront. Betterment has lower fees (.15 x .25) but doesn’t offer direct indexing. Wondering if direct indexing will make up for, or exceed, the .10 extra I’d pay if I went with Wealthfront. This is an account I’d contribute to every month.

MMM, I’m curious why you chose Betterment over Wealthfront?

Andrew February 15, 2017, 8:46 pm

Moneycle, I see your comment was in April. How’s it going for you? Just found MMM and am intrigued. Most of my investments to date have been in IRA’s, but now moving savings and a cash account ready to invest. Is this what you did with Betterment? TIA.

Ariel August 10, 2016, 12:03 am

Your comment is awaiting moderation.

Does the .15% fee Betterment charges (or .25, or whatever, depending on investment amount) include the fees Vanguard charges them for the actual funds you invest in? Or is the total fee .15/.25 to Betterment +Vanguard-expense-ratio?

Abel September 16, 2016, 8:39 am

Its in “addition” to the actual fees are much higher you have to add the fee .15-.25 to the fee of each individual fund.

VTI as an example is: 0.5, VTV: 0.8

Then there is also the bid/ask spread. So the true cost is at a minimum for VTI (0.20 – 0.30) and the bid/ask spread.

Brian January 13, 2015, 9:12 am

I started using Betterment after reading your post about it. I think it would be helpful to point out (or maybe I missed it) that the lowest fee level requires you to have at least $100,000 in your account. Another threshold requires at least $10,000 or auto-depositing at least $100 each month. If you don’t meet any of this criteria, the fee is higher. I don’t recall the numbers off the top of my head or if the highest fee is lower than the competitions though.

Mr. Money Mustache January 17, 2015, 7:57 pm

Thanks Brian, I added a link to their fee structure in this article. It’s roughly like this:

0.35% for balances under $10k (so the fee maxes out at $3/month for $9999 balance)

0.25% for $10k-$99,999 (maximum fee would be about $21/month for $99,999)

Then the fee drops to $13/month for a $100k balance, and scales up with balance from there.

Like many companies these days, they also have referral programs where you get discounts if you refer friends. I’m not using any for my account, just because I want to keep the results undistorted for this experiment.

Chris February 29, 2016, 8:02 pm

If you’re somewhat realistic in considering betterment, a $100 a month auto deposit is a very smart way to go. Lowest fees available, with a very small amount of money required. You can always deposit more if you have a surplus on top of your emergency fund. :)

John March 2, 2025, 7:47 am

I am new to your website but have been reading numerous personal finance books, including yours, which is how I learned of your newsletter. My question is, I inherited 300k which is managed by a brokerage who uses a Fidelity account. Their fees are 1.3%. I realize these fees are high but was told by my accountant that if I transfer my stock portfolio to a lesser fee like Betterment that stocks might not transfer and would have to be sold hence taxed. I struggle with determining if the taxes I’ll pay are worth the lower fees. Your suggestions would be appreciated.

What I struggle with is the taxes I pay worth the fee savings.

Mr. Money Mustache March 2, 2025, 7:58 pm

Good luck on sorting that out John – there is a way!

First of all, Fidelity is normally a good company with low fees. I’m not sure from your description if there are two institutions involved (a financial advisor perhaps, and then Fidelity underneath?)

If it’s just Fidelity, you can probably just cancel the advisory service and have the stocks left in a standard zero-fee brokerage account for you, no need to transfer to anywhere else.

If you did want to bring your money to Betterment specifically, then yes you’d probably have to sell the shares, pay taxes, and start again with the new portfolio. But that might not be the best idea. We don’t have enough detail here within the context of some blog comments to figure it out, but I hope you get the help and advice you need.

Peter January 13, 2015, 9:30 am

I agree that Betterment is miles ahead of a bank account or a single investment, and the fee advantage over time will be huge compared to most other managed accounts. It is surprisingly low in badassity, however. For those planning to live off their savings for the rest of their life, these are substandard returns, and doing better is the most important investment you can make over the long haul.. A dedicated independent investor with time and motivation CAN do much better on their own. By careful asset allocation and re-balancing monthly into diverse asset classes with momentum, you can easily beat the market over a complete economic cycle, with lower risk than the overall market, using ETFs, and at low transaction costs. You have have discipline and be willing to experience returns that go against the market at times, but it pays off in the long run. For those interested in doing their own research, I recommend papers/books by Meb Faber and Wesley R. Gray.

Chris May 3, 2015, 2:22 pm

Peter, there are VERY few people who can consistently beat the market. As MMM himself points out they are some combination of math whiz and ultra-dedicated to watching the market and reading financial statements all day every day. For those VERY few people, your advice probably holds. For everyone else (99.99% of the population) MMM’s recommendation of indexing/robo-advisor is better.

Mike H. July 29, 2015, 7:53 am

I’m late to the party here, but I agree with Chris wholeheartedly. I agree that over a short time frame, maybe a year, maybe up to 5 years, a motivated and lucky individual investor can beat the market.

But over 30 years? The very best investment you could have made 30 years ago was to buy an S&P 500 index fund and dollar cost average in ever since. Even taking into account the several recessions since then, you’d have come out ahead like gangbusters.

Read DALBAR’s most-recent Quantitative Analysis of Investor Behavior. IIRC, the market made approx. 11% returns over the last 30 years. The average individual made 1.85%, which is a full percentage point less than inflation over the same time period!!

Thank you, I’ll take the market as my core investment.

Jumbo millions March 19, 2016, 6:55 am

So Peter what are your returns and how many hours of your time did it take achieve that? You realy should keep track I think it might be eye opening for you

Paloma January 13, 2015, 9:49 am

Hello,

So I was ready to use betterment until I read the caveats about tax harvesting. I make 36k a year (pay my own health insurance on the marketplace)… Currently have 5k in a few stocks, and I have around 5k in a savings account. Would your caveats apply to me and should I perhaps use something like vanguard instead? Thank you!

Mr. Money Mustache January 16, 2015, 6:18 pm

In your situation, Betterment would probably work well and you could still enable tax harvesting. It wouldn’t save you a huge amount every year, but still would probably pay for the Betterment account itself. Even with harvesting disabled, it is still a worthwhile service.

Edit: As of April 2015 Betterment provides the Tax Loss Harvesting service free on all accounts. Paloma would be in their 0.25% fee bracket ($25/year on a $10k account), but Dodge’s other points still apply below.

Dodge January 20, 2015, 7:12 pm

Even if Paloma had the $50,000 required in Betterment to get access to their Tax Loss Harvesting feature, her low tax bracket almost guarantees that the 0.51% ER (yearly fee) on her portfolio will overcome any benefit gained the first year. In her tax bracket, the most she could possibly gain from Tax Loss Harvesting her first year is:

Maximum Deductible: $3,000

Maximum reduction in taxes from that deductible: $300

Yearly fee on her portfolio: $255

Maximum possible gain from Tax Loss Harvesting: $45

Yearly fee on the Vanguard equivalent fully automatic portfolio: $80

Even worse, after the first year or two, that same $50,000 deposit will likely never receive Tax Loss Harvesting again, as there will simply be no losses to harvest. This has been the case for every single year that the ETFs in Betterment’s portfolio have been around. When you think about it, if you’re investing with the expectation that your money will grow, you must also acknowledge that Tax Loss Harvesting on any one particular deposit will eventually not be possible (there will be no losses to harvest). After a few years, the cost from the higher fee will negate the early benefit from TLH, and it’s all downhill from there.

Said another way, why recommend Paloma pay a higher *percentage fee* on her portfolio, each and every year, for the rest of her life…to save forty-five bucks the first year?

Dodge January 21, 2015, 9:41 am

Numbers are a bit off. It’s a 0.41% ER with a $50,000 investment, so the yearly fee would be $205. So the +300 from Tax Loss Harvesting – the $205 fee, gives you a net gain of $95 the first year.

Chad April 28, 2015, 3:26 pm

Is it correct to say that tax harvesting doesn’t apply to an IRA? True, you aren’t paying taxes yearly, but aren’t you going to have to pay taxes on the gains as you take distributions out of the IRA, and won’t those gains be lowered if a tax harvesting strategy has been applied to the investments?

Dōitashimashite April 28, 2015, 9:36 pm

I’m not an expert in this, but from my reading of the tax books it looks like, Yes, tax-harvesting basically doesn’t matter in an IRA. Whether you keep it all in a CD earning a straight interest that you never ever sell, or day trade with options, in the end it only matters if the IRA is of the traditional or ROTH variety.

If it is traditional, you are taxed on ALL money withdrawn after you are 65. That’s ALL money, doesn’t matter if you tripled your investment or lost half. (Remember, you dodged taxes on the income contributed going in.) You also have required minimum distributions (RMD) once you are 70.5 years old. (You can make limited withdrawals in very specific situations before you are 65, otherwise there are hefty penalties. These, again, are independent of gains or losses.

If it is a ROTH, you are NOT taxed on all money withdrawn after you are 65. That’s NO taxes, again doesn’t matter if you tripled your investment or lost half. (You paid taxes going in.) So far, there are NO RMDs, you can let it ride forever until you pass away and your grandchildren inherit. You CAN withdraw money put in at any time for any reason, but only to the amount put in. (For example, you contribute $5500 this year. It makes 10% by Dec, to a balance of $6550…. when you need cash for some emergency! You can withdraw the $5500 back out, but must leave the $550 earnings in until age 65.)

Doesn’t matter when you sell, or “harvest losses”. Just make sure you make money!

Karen April 18, 2016, 7:47 pm

Hello, I have been following your block and reading some of your posts, thank you so much. It all has been really useful to me. This is the first time ever that I comment a blog, so I hope it works, I live in Australia and would like to know if there is a similar company to Betterment here or can I still invest with them? sorry about the ignorance, I am just starting to learn and have bought my first book “The four pillars of investment”. I am thinking to invest 10.000 Australian dollars. Thank you so much..

Nice joy September 7, 2016, 10:19 am

To paloma

I think you should max out any 401 k 0r 403 b and then invest in vanguard IRA..[ you don’t have benefit of TLH for IRA] The ER for those accounts [401] may be heigh but you are being benefit of tax savings. then if you have extra money invest with betterment in taxable accounts and move that money to vanguard after 2 to 3 years [ after getting benefit of TLH].

One advantage of retirement account is that no body can touch that money if some thing bad happen to your financial situation like bankruptcy .

Eric October 10, 2016, 5:09 pm

Only 401ks are protected in bankruptcy. IRAs are not.

threewolfmoon April 18, 2017, 8:25 am

While 401k accounts are protected by federal law from being taken in a bankruptcy, the ultimate answer depends on your state of residence – some states (like CO where I live) IRAs are also protected from creditors in bankruptcy.

Paul April 18, 2017, 10:42 am

Better double check this. I believe under federal law, both ERISA and non-ERISA retirement plans are not part of the bankruptcy estate, up to about 1.2M. This includes 401ks and IRAs. Under this federal law, states are not allowed to opt out. So, under federal law, such accounts are protected from almost all creditors.

Awaywego January 13, 2015, 5:04 pm

Can someone explain to me how MMM calculated that amount of money you would receive in dividends annually if you owned $100,000 of the two Vanguard funds VTI and VXUS? I was looking at the numbers on Vanguard’s site and don’t know how to crunch the numbers…

From what I understand, it’s not a difficult thing to calculate, but I can’t figure out how to get the numbers that he is getting.

Mr. Money Mustache January 17, 2015, 7:59 pm

Hi Away, I got those dividend numbers from the Nasdaq.com website, which has an excellent interface for digging up historical data like that. You’ll find the links at the bottom of my article above.

Bradley Curran January 13, 2015, 6:13 pm

Thanks for the write up! This is a perfect way for me to get started in investing.

I’ve been the savings account guy for too long! :)

Evan January 13, 2015, 11:21 pm

Hey MMM- great info here, Betterment seems like an awesome place to ‘stash funds after maxing out tax advantaged accounts.

Question for you, have you ever written an article about purchasing stock options from an employer? My employer offers an option where we can buy stock for 15% off the lower of the price at the beginning of a given quarter and the end of the quarter. Some friends I know working at other companies have similar setups.

Where does an option like this fit in to the investing continuum? Obviously you are putting your eggs into one basket to a large extent, but 15%+ returns off the top are pretty appealing.

Alex January 16, 2015, 8:55 am

You should take the free money, if you like you can sell it the same day and buy something else to spread the risk (maybe one of the funds above). A 15% profit in 3 months seems hard to beat for any fund.

Evan January 16, 2015, 3:34 pm

We have to hold the stock for at least a year before we sell. I heard it used to be the way you describe, but alas, no more.

My gut tells me it’s a good option for investing after maxing out 401k and Roth IRA, and likely diversifying between employee stock and taxable index funds.

I’m very curious about MMM’s take because it sounds like something he took advantage of while he was working, but after reading most articles on here I don’t recall him covering it in detail.

Mackenzie April 10, 2015, 3:30 pm

Usually with an ESPP it’s that you have to hold it for a year to get capital gains tax rate instead of income tax rate. You might want to double check.

SC May 1, 2015, 10:27 am

Talked to a CPA this year about ESPP. She said taxes are paid when the stock comes to you. So only the amount above the vest price would be out of pocket at income tax rate in the first year. ie. Cashing out right away means you’d only pay a sliver of income tax on the earnings after vesting.

Mr. Money Mustache January 16, 2015, 5:04 pm

Hi Evan,

I’d agree with Alex above: I did participate up to the maximum in Cisco’s employee stock purchase plan for all 5 years of my work there, because the odds were strongly in our favor: 15% discount, and your purchase price is the lower of the start or end price of each 6-month rollover period.

But then I generally sold my stock options and employee stock purchase plan shares as soon as they were available to sell. After all, if you wouldn’t BUY your company’s shares with your own money, should you keep them once they are handed to you?

There was one exception where Cisco shares went down to $7 when the P/E ratio suggested they were worth $20 – in that situation I held on for a year or less and sold them at $20. A few good profits there, but the program was limited to 10% of your salary.

ahawkchick August 17, 2015, 9:34 pm

I have been really curious about this topic as well! Hubby and I work at the same place and currently he puts 10% while I do 20% to the espp. We do have to hold for a minimum of 1 year. My hesitation with selling shares as we are able to is that we’re currently each making > 100000 so I’m thinking the tax hit we’d take from the gains will impact is more now than they will later when we are FIRE and our income is lower. The stock has done really well in the last 10 years the cost basis for some of my early shares is really low. Am I correct in my thinking about the tax implications?

Dave November 14, 2016, 9:35 am

Nortel, Enron, etc. were also “doing well”, before they were not. Please don’t put too many eggs in one basket. Especially when that basket is also your employer, and especially when that basket is also your spouse’s employer.

nostache January 14, 2015, 8:29 am

Dang! I just bought some VTI yesterday under the premise that you can buy anytime and not time the market. Should I sell it for VXUS instead?

GordonsGecko January 14, 2015, 9:15 am

Nostache – Just keep buying regularly. You’ll be dollar-cost-averaging in at different value points this way. Time in the Market is far more important than timing the market.

And you should almost never base investment purchase/sale decisions on what happened over a 3 month span. That said, if you’re putting in large lump-sums, it isn’t a bad idea to take a look at the P/E for the S&P or broader market to see how the overall valuation looks compared to historical.

I believe Mr. Moneymustache has an entire post about that strategery.

sneetz January 14, 2015, 4:43 pm

If you are concerned by today’s market drop, then No! VTI is a fine fund. Low fees, etc. Just buy and hold. Some days it will drop, like today, and other days it will jump up. Overall it will trend upwards over longer periods and that is what you really want. If you sell your VTI now, you will lock in your losses. That is a rookie move.

Dōitashimashite January 14, 2015, 7:47 pm

Short answer, no don’t sell. If you buy regularly (say once a month) with whatever investing money you have, you won’t be timing the market.

Mike M January 16, 2015, 1:33 am

Generally trying to time the market is a fool’s errand. You’re just fine (and honestly probably better off) just buying anytime.

Mr. FI January 14, 2015, 10:29 am

I love Betterment. I’ve read almost all their blog posts explaining their thought process behind how they weight portfolios, their dividend reinvestment/rebalancing automation, etc. it just makes a lot of sense to me.

There’s a fair amount of Betterment bashing on the forums, so it’s nice to have the creator of the forums in the corner of Betterment. Not to say that investing in a Vanguard index fund isn’t great, it clearly is, but I believe, like you stated, that Betterment offers more than enough to compensate for their very low added fee rate.

M from Loveland January 14, 2015, 12:18 pm

Robo advisers…lmaof!!!, that’s a good definition.

Thanks for the update on your Betterment financial experiment. I think is very helpful to see how it works with real life investing. Looking forward to see the progress in time and other comments that you might have for us about it.

DrFunk January 15, 2015, 11:11 am

Thanks for the update MMM! Really looking forward to tracking this experiment in real time.

MRog January 16, 2015, 1:36 pm

I max out my TSP and a Roth IRA. If I want to open up a Betterment account in order to put my previous ’emergency fund’ into, will Tax Loss Harvesting be applicable to me? Or would I be almost be better off using my 2015 contribution for tax free growth in the Roth IRA? I have about $8K line of springy credit for the emergencies and still would have a few thousand in cash. Government job, very secure as a technical professional luckily. 25 and on my way to financial freedom! All tips are appreciated.

Peter January 16, 2015, 7:08 pm

I have both Betterment (90% stocks, 10% bonds) and VTSAX (like VTI, but a mutual fund not ETF). In a 90/10 Betterment portfolio, almost 40% is invested in VEA, which has not been doing well, but of course could rise in the future. What is your Betterment stock/bond ratio? Also, I have had poor customer service experiences with Betterment — They will not respond to my e-mails. When I complained over the phone, I basically got a shrug and was told that everyone else thinks they provide excellent customer service.

Tricia March 4, 2015, 1:40 pm

Hi Peter,

Tricia from Betterment here. I’m sorry to hear that you’ve had a negative experience with us. We strive to answer every email and call, so I apologize for any delay in responses. I will pass your feedback to our customer experience team.Please don’t hesitate to contact us again, if you have any questions or concerns.

Philip January 18, 2015, 10:16 am

MMM, what do you think of Wealthfront? Have you thought about including them in your Betterment vs. Vanguard experiment?

Bob January 18, 2015, 12:59 pm

One disadvantage of using Betterment for IRA’s is the method of paying their management fee which is taken from your retirement account. It is better to pay this fee from outside your retirement account allowing you to maximize it’s size.

Sebastian January 20, 2015, 6:49 am

Thank you for this article and the follow up. I am sure some people in this forum will relate to my situation.

I have a $120K invested (taxable account) in a dozen funds with my financial advisor that I want to take control (no more ridiculous fees). The actual funds are a good mix. To move it to Betterment, I am forced to liquidate all funds which will hit me with $20K in capital gain taxes. The other option is to move the funds to Vanguard and avoid the advisor’s fees.

What is you take?

Dōitashimashite January 23, 2015, 12:36 pm

Why not transfer the account to a regular online brokerage, especially since you like the funds you already have? Most will cover transfer fees, or even give you money to do it. TD Ameritrade, for example, will give you $300.

“To receive the reward you’ve selected, you must open a TD Ameritrade account and fund it with a minimum of $2,000 within 90 days of your submission.” Sounds like you have that amount, no problem!

When you fill out the paperwork, just say don’t liquidate, keep all the funds you already have. Easy.

Email me if you want help: adamhargrove at yahoo

Noy April 13, 2016, 11:44 am

Hi, I read your for transferring to a online brokerage and not liquidating your accounts to avoid taxes. I would like to move my money from my current broker to a Vanguard index your fund. How can I do that without liquidating and having to pay tax? Thanks.

MICHAEL April 15, 2016, 7:11 am

Hope you don’t mine me adding a comment. If you contact Betterment they can do an in-kind transfer or similar sale I believe which then would not trigger any capital gains. If I am not mistaken, they can also sell investments at optimal times too to minmize taxes but you need to call them for details. I wouldn’t plan my portfolio around tax avoidance though and don’t be afraid of capital gains…it means you are making money :-)

Fitch February 23, 2015, 4:30 pm

To have a $20k cap gains tax bill you would have to have $133k in profits, which obviously you don’t since you said there is $120k in the account in total. They only tax the money you gained, not the principle.

Dodge January 20, 2015, 12:50 pm

This still doesn’t make sense to me MMM. When I talk to newbies about investing, I give them two recommendations. Here are two fully-automatic funds which will take care of literally everything for you. It’s so automatic, that after you create your account, and tell Vanguard how much you want to contribute monthly from your bank account, *you never have to login again until you need the money*

It all depends on how how automatic you want it to be:

1. If you’d like to choose your own amount of risk, you can fill out the a short survey and Vanguard will recommend a level of risk for you. Simply invest in a LifeStrategy fund per their recommendation, or choose your own. These funds have a low ER (yearly fee) at 0.16% (16 hundredths of a single percentage point), and will do everything for you. 0 maintenance required.

https://investor.vanguard.com/mutual-funds/lifestrategy/#/

2. If you don’t even want to choose the risk, and want a truly full-automatic account, simply tell Vanguard the year you’d like to retire, and they will handle the risk decision for you, along with everything else. These are the Target Retirement funds:

https://investor.vanguard.com/mutual-funds/target-retirement/#/

I don’t understand how you can justify an ER of 0.31% – 0.51% (Betterment’s fee on top of the fee from the investments they choose) at Betterment, by saying it’s simpler, when these same options are available directly at Vanguard (instead of paying Betterment to invest in Vanguard funds for you), for a significantly lower cost. If we follow the numbers in your example, this decision will cost your readers hundreds of thousands more in fees over their lifetime:

http://i.imgur.com/HCwH2DI.png

The Vanguard automatic funds are cheaper, hold 19,777 unique stocks and bonds across the world (much more diversified), and are just as automatic.

How can you justify this?

Sebastian January 21, 2015, 11:06 am

Dodge, you are right about those options at Vanguard and they are great.

The LifeStrategy are actually a combination of 4 “Total X Market Index” funds. The LifeStrategy Growth Fund (VASGX) has 0.17% as expense ratio. You could invest the same portfolio on your own for 0.082% (ETFs in parenthesis): 56.6% VTSAX (or VTI) with 0.05% ER; 23.3% VTIAX (VXUS) with 0.14% ER; 16.1% VBTLX (or BND) with 0.08% and VTABX (or BNDX) with 0.2% ER.

Regarding Betterment’s fees, there are no fees on top of fees. The fee you pay covers everything and ranges from 0.15% to 0.35%. If you invest $100K or more you fee is 0.15% and that’s it. You also have the TLH feature that can more than pay those fees (~0.77%). That is MMM is promoting this.

Hope this explanation helps.

Dodge January 21, 2015, 12:01 pm

Incorrect, Betterment’s fee is *on top* of the fee on the underlying funds. Betterment takes your money, and invests them in ETFs for you. These ETFs have their own Expense Ratio. It is impossible to be invested in these ETFs without paying their Expense Ratio.

The math shows that after a few years (between 1 and 3 typically), any particular deposit will pay more in fees, than it gains in Tax Loss Harvesting. If you’re investing with the expectation that your money will grow, you must also acknowledge that Tax Loss Harvesting on any one particular deposit will eventually not be possible (there will be no losses to harvest). On average all TLH activity stops on any particular deposit after about a year.

After a few years, the cost from the higher fee will negate the early benefit from TLH, and it’s all downhill from there. This has been the case for every single year that the ETFs in Betterment’s portfolio have been around. You can mask this, by continuing to deposit higher and higher amounts, to capture a bigger and bigger first-year benefit, but you’re really just doubling down on higher and higher fees. Sooner or later, it will catch up with you.

It is inevitable, for the simple reason that the fees are both *percentage based* (so they get higher as your account grows), and *forever* (each and every year, for the rest of your life), while the tax loss harvesting benefit is *temporary*.

Sebastian February 1, 2015, 3:19 pm

You are completely right Dodge. Thank you for correcting me.

I actually called Betterment and asked them about the “fees on top of fees” and they said that was correct. I don’t see the reason (at least for me) why I want to pay an extra 0.15% on top of the Vanguard funds I will choose anyway.

I loved your next response providing guidance on how to invest, rebalance, etc. Keep it up!

Alex May 4, 2016, 12:50 am

Hi Dodge,

Thanks for the insightful post. I’ve seen arguments made against TLH over the long term, and I feel like I’ve never seen a good counterpoint made in response. That MMM didn’t seem to address it here is perplexing to me.

If one has received a TLH for a given investment in Betterment, then maybe they can then do an in-kind transfer to VG to avoid the perpetual Betterment fee? :P

Nice joy September 6, 2016, 10:40 pm

You are talking about admiral shares with low fees…. This is not applicable for those with low balance ….Most of the admiral shares need >10 000 in that fund group …you may need 100k or more to get admiral shares in all 4 categories with low ER …. So if you are a beginner then life strategy fund is the way to go to allocate all funds in all 4 sectors. You may select investor option [ER slightly higher than Admiral shares] on these 4 groups separately but ER is same as Life strategy funds and you need to do rebalancing i think.

Nice joy September 6, 2016, 10:41 pm

I am replying to sebastian

Mr. Money Mustache January 23, 2015, 8:42 pm

Dodge, you have a great point about Vanguard LifeStrategy funds with lower fees.

I’d still pick my Betterment 90/10 allocation over those options for my own taste, just because Life Strategy doesn’t go below 20% bonds, even when you select the “growth” option.

I also don’t want the allocation to switch automatically more towards bonds as I get older, which I think the Life strategy funds did when I last read about them(?)

Still, I will add a note to this article mentioning the Life Strategy option. They take care of the biggest issue: one-stop investing with automatic rebalancing.

More feedback always welcome, as this is after all an experiment.

Dodge January 24, 2015, 9:21 pm

The LifeStrategy funds have a fixed asset allocation, it’s the Target Retirement funds which glide toward bonds as you get older.

Betterment’s 90/10 portfolio contains half US Stocks, and half International Stocks, so I’m not sure what value we get from comparing it to a 100% US Stock portfolio, and a 100% International Stock portfolio. It will likely perform in the lower-middle of the lower fee 100% stock funds. A bit lower because of the 10% bonds, and the up to 4x higher fees. That’s what we’re seeing from the chart so far.

Why not compare Betterment’s automatic fund to Vanguard’s automatic fund, or heck, throw wisebanyan.com in there. WiseBanyan’s automatic fund doesn’t include any extra fees outside of the ETFs they put you in, making their automatic fund the cheapest of them all, with an average ER in 2013 of 0.11% (compared to Betterment’s 0.31% and Vanguard’s 0.16%).

https://wisebanyan.com/faq#our-investment-strategy

Schwab is releasing their own automatic fund, also with 0 extra fees, in a month or two:

https://intelligent.schwab.com

This space is certainly heating up! Personally, after reading Vanguard’s “Best practices for portfolio rebalancing” study:

http://www.vanguard.com/pdf/icrpr.pdf

Rebalancing just doesn’t seem to be that big of a deal. They recommend looking at the portfolio once a year, and rebalancing only if it deviates by 5% from your target. If it doesn’t deviate, don’t rebalance. They did the math using market returns from 1926-2009, and only had to rebalance 28 times. Most years a rebalance wasn’t necessary. They charted it out for us:

http://i.imgur.com/B11B9Jc.png

Here’s how I recommend newbies invest. Open an account at Vanguard, and invest your money in:

56% Total Stock Market Index Admiral Shares – VTSAX (3804 stocks across the USA)

24% Total International Stock Index Admiral Shares – VTIAX (5785 stocks across the world, excluding USA stocks)

20% Total Bond Market Index Admiral Shares – VBTLX (6948 bonds across the USA)

Invest any new money in exactly those same allocations, don’t even worry about rebalancing new money. You can even tell Vanguard to automatically invest the money each month for you, withdrawing it from your checking/savings account:

http://i.imgur.com/aF5vJI4.jpg

That’s it. No need to even login to your account anymore, unless you want to change the $2,000 auto-deposit. After one year, log in to your account. Put the numbers into the calculator, and see if the percentages are more than 5% off. If it looks like this, then great! No need to rebalance this year! Feel free to logout knowing you won’t have to sign back in for another year:

http://i.imgur.com/PbI4B9x.png

If the numbers are off, the calculator notifies you, and tells you the 3 trades it takes to fix it. Spend the next few minutes buying/selling as indicated on the right:

http://i.imgur.com/WkNi11K.png

And that’s it! You’re done for the year. The fee for such a portfolio is about 0.07%, compared to 0.41% had the money been with Betterment. The difference between 0.31% and 0.07% using your numbers above ($100,000 deposit, and adding $1,000 a month) is about $568,088 extra fees after 35 years. No it’s not “one-stop” investing, but I think it’s important to see how easy rebalancing is, before paying someone a yearly percentage fee on your portfolio to do it for you.

If they can’t handle the emotions of buying/selling in the portfolio, then yes, an automatic fund can make sense. That said, it’d be great to see a non-fee company like WiseBanyan in the experiment, so we can see if the extra fees are worth it :)

Mr. Money Mustache April 7, 2015, 9:31 pm

How did you get that $568k figure Dodge?

100k+1k/month compounded at 7% for 35 years becomes: $2,726,500

The same thing but compounded at 6.66% becomes $2,495,860 ($230k less)

The difference is significant, but the real results over such a long period would also depend on how well the tax loss harvesting worked, and how your allocation and rebalancing strategy compared to Betterment’s.

Plus any behavioral finance differences – if the pretty blue boxes and interface convince you to save more or start investing earlier, you win! You have to remember that for most people, even seeing this conversation we’re having is enough to shut down their enthusiasm for investing for another year.

Dodge April 20, 2015, 6:03 pm

Not adjusting for inflation, I simply checked the growth over the last 35 years:

http://i.imgur.com/sWExa5x.png

Then rounded down to 11.5%

http://i.imgur.com/mEqMDoa.png

If you adjust for inflation, then yes it would be closer to $230k in 2015 dollars.

I understand the behavioral factor, which is why I point complete newbies towards setting up automatic deductions directly to a LifeStrategy fund. It’s almost like a 401k account, once it’s setup, they never have to look at it again. If the pretty blue boxes entice people to login and constantly check their accounts, that can also lead to negative behavioral factors. I read a post on your forums from someone who sold all their Betterment holdings…because (as shown in your charts above) it lagged VTI (the US market) over the last few months, and they were expecting more. This is horrible reasoning (market timing), which might have been avoided if they setup automatic investments and never looked back. Yes, I know Betterment supports automatic investments too, but like you said, pretty blue boxes!

If we really want to get serious about behavioral finance, I’d argue it’s possible the majority of people seeing this conversation, would be much better off with a 60/40 stock/bond portfolio over the long run vs 90/10. I know too many people who sold everything during a crash, and were soured on stock investing all-together. I don’t have any data on this, but it’d be interesting to see.

If your blog has taught me anything, it’s how to determine long-term value. How much is that $10 lunch REALLY worth over the long term? What about that seemingly innocent $300 car payment? I can afford it right? You taught me, that these are not the right questions:

—————————–

So when deciding whether I want an iPad 3, I don’t ask myself if it would be fun or convenient. That’s the wrong question. I ask myself, “will this thing really increase the level of my lifelong happiness?”.

http://www.mrmoneymustache.com/2012/03/14/why-i-am-so-not-buying-an-ipad-3/

—————————–

Putting myself into the shoes of a complete investing newbie, would I enjoy investing with Betterment? Sure. Is it convenient? It seems so. Can I afford it? Definitely. Am I going to do it? HELL NO!!! And why would I, when WiseBanyan offers the same convenience, the same one-stop-shopping, and the same pretty blue boxes, for no extra fee? WiseBanyan’s total fee of 0.12% is cheaper than Betterment’s 0.31%, and even cheaper than Vanguard’s Lifestrategy 0.16%

You’ve shown me the long term effects of a $10 lunch, a $300 car payment, and yes, even a 0.19% yearly fee on my life savings. After seeing the math, it’s clear these decisions will not increase the level of my lifelong happiness.

I’m finally asking the right questions, and I have you to thank for that :)

sser April 20, 2015, 11:01 am

Hello Dodge, MMM, and all,

First, thank you for the excellent discussions! I have learned quite a bit just by reading though this post and the corresponding comments. It’s exciting, though also a lot to take in. Hopefully I’ll build up enough understanding at some point to really invest well (and live more frugally).

Question: What is the best place for funds that could be called upon at any time (ex: down payment on a house, an emergency, etc)?

As a government worker at 29 years old, I have been contributing 6% to the TSP and work will match 4% (plus a mandatory 0.8% from me and 1% from work). My TSP is mostly in their 2040 and 2050 target date funds, which seem to be doing alright. I also max out my Roth IRA, most of which is invested in Vanguard’s 2045 and 2050 target date funds.

At this point, I have 35k to 45k that I want to move out of my savings account and into index funds. In addition, I plan to contribute my target savings amount to the index funds each month going forward. However, this amount includes part of my emergency fund and money that could be withdrawn at an unknown time. Since I live in the DC area, I do not have a car and I rent (which is high, but building up a good down payment for even a small condo here is tough, and I do not know how long I will be in the area), this money could go toward buying a home or ‘ideally’ paying cash for a decent used car at some point in the near or distant future, depending on what makes sense at the time.

Dodge’s suggested allocation for Vanguard funds above sounds right, and it looks like 42k or more would let me get into a few of the Admiral Share levels. However, I know that changes in the market or a withdrawal could bump me back down to the Investor Share level (though Vanguard will automatically move you to Admiral each quarter if you qualify).

KEY QUESTIONS:

Should I put the money into Vanguard using something like Dodge’s asset allocation and just not worry about getting bumped between Admiral and Investor Share levels (due to market changes or withdrawals, etc)?

Or should I consider using WiseBanyan or Betterment instead until I have built up enough funds to put in something like VTSAX more permanently?

Sorry that this was a bit long! I wanted to make sure that I was communicating my currently financial position and concerns accurately.

Thank you!

Moneycle April 23, 2015, 7:38 pm

sser,

Personally, I’m all about keep-it-simple and I like that you are already using Vanguard’s Target Retirement funds. They have a good mix of domestic/international stocks/bonds that should be about 90% stocks for your target dates. I say you just put your extra money into that and forget about it. Betterment is a decent option as well as they make it easy.

Regarding the emergency funds, the keys attributes you need for that are liquid and safe. The safest place is in your bank and you can earn a little bit by buying a CD at the bank. It’s not going to earn a lot of money but that’s not what emergency funds are about. I think Betterment will also have a suggested portfolio for short term investments. You might give that a try to see if you like it.

Also, don’t buy a house if you’re not sure you’re going to stick around. There’s no shame in renting and often it is the right financial choice.

JesseA January 8, 2016, 12:45 pm

sser,

I would take advantage of the TSP to the fullest before venturing to Vanguard. Contribute up to the 17,500 a year if you have the means to. You can get close to the standard three fund portfolio inside of the TSP, with a combination of C,S,I and instead of F use the G fund.

You absolutely cannot beat the expense ratios of the TSP. No if’s ands or buts.

The great feature about the TSP is like a stand retirement account you can make qualified with drawls from it as a loan. Meaning, say you want to buy a house. You can take a loan from your own account, and pay yourself back with 4% interested. In general you should touch your retirement account. However if you can guarantee a 4% return for the duration of the loan it is better than buying most bonds. All the interest goes back into your account.

I love Vanguard, but I would only look at Vanguard after you have taken complete advantage of the TSP or you really don’t like the fund options.

Nice joy September 6, 2016, 11:15 pm

I think you should max your TSP. TSP ER ratio is 0.29. But you are making your money grow 25 to 30% [Assuming your tax bracket] as soon as you invest. TSP life cycle fund is performing well and has a mix of us and international stocks/bonds. Once you Max out TSP then think about Vanguard IRA with Life strategy funds or target retirement funds. [TLH is not applicable to IRA} . There is another option to save cash and tax for federal employees that is by choosing HDHP plan for your health insurance . You can contribute up to 5500 [approximate] per year ….you are saving 25 to 30 %….That is is your emergency fund for your health….the fun part is you can also invest this money in different kinds of ETF or target date funds. It is a great option you you are young and in good health….still got extra money start IRA for your spouse and max out her 401 k and now you are almost tax free…Watch out for your open season…I have Aetna HDHP Plan

TeriR September 5, 2015, 12:53 am

Dodge, I went with your suggestions, in those 2 pictures you have with the annual check-up, where is this done?

Is this on the Vanguard website or is that some app you are using? Sorry if the question is noobish, thanks!

Tyler November 8, 2015, 5:36 pm

Dodge-

I’m basically brand new to investing period. So brand new, that I happened upon this article and your comment today and I have less than $15,000 in my bank for emergency savings. Thankfully my wife and I are 21 and 20 respectively so we have some time to work with. While I really like the idea of Vanguard investing, I just don’t have the ability and peace of mind to be able to invest $10,000 minimum in vanguard accounts. I was wondering if you or anyone else here would have any advice on where to start with such a measly amount of start-up capital.

Thanks so much!

Mr. Money Mustache November 9, 2015, 6:58 am

Hi Tyler – you only need $2000 to start with Vanguard, or possibly even less if you just get a “Vanguard Brokerage” account and buy the ETF version of their index funds. Good luck and keep reading about investing!

julz837 November 9, 2015, 1:22 pm

$3000 is the minimum for Vanguard funds, and it is $1000 for Vanguard Target Retirement Funds. I have been a Vanguard fan ever since you first mentioned them!

Bob March 1, 2016, 9:40 pm

What MMM is saying is that you don’t need the minimum for Vanguard Admiral Shares because the corresponding ETF usually has the same ER as the Admiral Share (e.g., VTSAX has the same ER as VTI (the corresponding ETF). You buy the ETF like a share and only need a Vanguard account to do so.

AK December 20, 2015, 2:01 pm

Dodge,

I’m a bit late to this post, but I have a question if you happen to see this. I liked your simple annual rebalancing strategy and the corresponding spreadsheet which is shown in the referenced image “http://i.imgur.com/PbI4B9x.png”, but I can’t figure out how you calculated the “Your portfolio is off by” value. And that value is the trigger to determine whether or not an investor should rebalance.

Could you explain how you calculated the “Your portfolio is off by” value?

Thanks.

Troy January 9, 2016, 2:01 am

Dodge, I’m just a bit confused about Admiral shares. Can I get in on your 56/24/20 split without investing more than $15,000.00 to start? From what I’ve read, you need $10,000.00 to get in on most Admiral shares funds – so would I need at least $10,000.00 in *each* of those three?

Jacob January 10, 2016, 9:39 pm

The Admiral class of shares does require a $10k minimum per fund. The investor shares require a $3k minimum at a slightly higher (though also very low) expense ratio. If you don’t have enough for even the investor class, you could buy the ETF that tracks the same index as the funds however you can’t convert the ETF into the fund version later. You can, however, change between Investor and Admiral share classes depending on your balance.

If you are on Vanguard’s website, simply typing the name of the fund (not the ticker) into the search bar will bring up all variants of it.

Nice joy September 6, 2016, 11:20 pm

You need 50 000 to get 10 000 on your 20% fund. Better of starting with life strategy fund and once you have 50 000 VG may let you change to admiral.

Sacha March 26, 2016, 8:43 am

Do the other services (Wisebanyan, Schwab…) also do Tax Loss Harvesting?

McDougal August 10, 2016, 6:21 am

Hi Dodge,

Would you tweak your recommendation for newbies in Vanguard if a person has only the next ten years to invest? I am 60 and have to work till around 68. Have around 400K in IRA but am getting killed in fees. Thx.

Nice joy September 6, 2016, 11:36 pm

https://investor.vanguard.com/mutual-funds/managed-payout/#/

I Just happened to find this from Vanguard website…..it may be very useful after you retire.

To invest now you may consider life strategy funds with low risk . The one with low risk only dropped 10% in 2008. ER around 0.15 for these . You may also choose admiral shares since you have good balance…. you have to do balancing in that case

McDougal September 9, 2016, 1:20 pm

Thanks Nicejoy, that’s Nice!

Ergin October 10, 2018, 3:10 pm

Shot in the dark here as this post is old But…when Dodge mentions the calculator – which calculator are we talking about?

Don September 29, 2020, 4:09 am

Dodge,

Just to give feedback on the Schwab Intelligent Investor portfolio. Only after $50,000 does the TLH start. Over 20 year customer of Schwab so I went in to my local office to speak to gentlemen assigned to my accounts. I had to fill out a form asking me about risks and a target date. Schwab assigned be all kinds of funds schwab funds 2 large caps, 2 small caps, Value, RIET, bond, and Internationals. It was a horrible mix of funds. I called to request removal of the international funds and it took me 3-5 months to get someone to finally override this. They said no you can not remove all international. I was shocked. This was only an experiment for me to see the advantages for TLH since I am over 34% federal bracket. Long story short it continuously under performed the S&P 500 by a good percentage. I held entirely too long to see if the LTH would make up the difference. No and they would switch funds at the worst times which seemed to have a negative impact. My long and true VOO, VOOG and VTI equal portfolia has done me well. VOO S&P 500 index etf, VOOG S&P 500 growth etf and VTI Total stock market etf. No brainer, no stress, no longer reading financials.

Moneycle February 5, 2015, 9:59 pm

Like Dodge, I think a better apples-to-apples comparison would be to compare Betterment to a Vanguard fund that has a 90/10 allocation. For example, target retirement funds that are more than 25 years out all have a 90/10 allocation so I would choose the Target Retirement 2060 (VTTSX) as a basis for your comparison.

Roger December 3, 2016, 11:12 am

MMM, can you point me to some of your articles that can explain why you choose a 90/10 allocation and do not want an allocation of even 20% in bonds? I am currently with Betterment at 70/30. I’m 62 years old but hope to not retire for several years. Thus I chose the more conservative route. Your thoughts and/or articles that might help?

Ravi February 21, 2015, 9:59 am

Dodge – you are exactly right!

I spent the past few days researching betterment vs alternative to decide if I should change my passive index approach approach. I have close to $1M in investable assets, but am semiretired so am in a low income bracket.

Based on my condition, it DOES NOT MAKE SENSE.

In fact, I wonder if it really makes sense long term for anyone.

I don’t see the point in paying the fee for a service like betterment vs investing in a low cost target date index fund. I think TLH gains are overblown, and over time, the additional .15% fee betterment charges (for over $500K invested) will grow to be a massive fee over 10-20 years.

Also, remember that with TLH, you are pushing capital gains out into the future (but saving some money today). I don’t think taxes have anywhere to go but UP. What happens in capital gains rates increase? The TLH strategy will blow up in their face. Of course, none is talking about that, definitely not betterment!

Another thing is the fees. Think .25% of even .15% (if you are lucky enough to qualify for their lowest rate) is small? Think again:

For example: $850K invested at 7% annual growth rate @ betterment .15% fee results in:

$19K in cumulative fees over 10 years

$56K in cumulative fees over 20 years

$272K in cumulative fees over 40 years

$1.6M in cumulative fees over 65 years (when I’ll be 100 years old)

When I turn 100 years old (and I plan to!), assuming initial 850K investment @7%, I’ll have a portfolio worth $70M but will have also payed $1.5M in fees! That is over 2% of my total portfolio paid in fees!

All this from just paying a small .15% over time….crazy how compounding works! The .15% fee is misleading since that is taken every year but most people won’t do the math…over time the cumulative effect is very large.

Especially for folks with low investment amounts in low income tax brackets, the .25% fee they charge is a killer. Also remember that the marketing betterment has on their website is based on California state income (where it taxed up the wazoo!). So their fancy tax loss harvesting may not yield as much gain for you.

Remember, investing is a “game of inches” and paying out a guaranteed fee for the promise of greater gain gives up those inches. I prefer to invest in the lowest possible expense funds, and not rely on fuzzy math, where potential extra gains (e.g. TLH) reply on IRS rules that are subject to change.

Right now, I invest with Fidelity Spartan funds (advantage class) in an 80/20 split (stocks vs bonds) and pay a combined .06% expense ratio for my entire portfolio. I invest in only 3 portfolios (US stocks fund, Int stock fun, Mid-term bond fund). I rebalance yearly and sleep well at night.

Betterment was so tempting since their interface is slick and it comes highly recommended from so many bloggers I follow. They also do a great job MARKETING….ahem, I mean educating…people on their blog about investing strategy.

HOWEVER, I refuse to give up a % of my hard earned lifetime of assets to a robot-investor. If they charges a flat fee, I would totally go for it…but they have NO RIGHT to claim a % of my assets each year. It’s not like they have high variable costs….it’s software doing the work, and it works just as hard for someone with $10,000K as it does for someone with $100K (in theory).

It’s ridiculous!

So I’m not getting sucked in.

Low cost indexing is where I’m sticking…for now!

One thing is for certain, the finance world is an exciting place right now…will be great to see how it evolves in the next few years.

…and thanks MMM for sharing your experience, it is only through that we can all learn and grow!

Ravi

http://Motivated.Life

Tarun August 7, 2015, 10:03 pm

Thank you Dodge, Ravi and MMM! I am very very new at this investing game and I’m learning a lot from all the discussions in this post. This is very very helpful.

I am still confused about all this fees business and hoping to seek some guidance from you all. Below are the index funds options provided for stocks in my employer’s 401(k) program. If I go with the simple math, maximum of ( 10 year average annual return – gross expense ratio),

WFA DISCOVERY INST and TRP INST LGCAP GRTH look good to me. If I just go by the highest value in ” 10 year average annual return,” WFA DISCOVERY INST and TRP INST LGCAP GRTH look good.

Name 10 year average annual return gross expense ratio

DODGE & COX STOCK (large cap) 7.2% 0.52%

SPTN 500 INDEX INST (large cap) 7.7% 0.05%

TRP INST LGCAP GRTH (large cap) 9.81% 0.56%

SPTN EXT MKT IDX ADV (mid cap) 9.08% 0.07%

WFA DISCOVERY INST (mid cap) 11.61% 0.87%

DFA US TARGET VALUE (small cap) 8.55% 0.37%

MFS INST INTL EQUITY (Intl) 7.66% 0.72%

SPTN GLB XUS IDX INS (Intl) 6.5% 0.23%