For a little over ten years, I have been contributing to an automated stock investing account, choosing Betterment out of a large and growing field of companies (affectionately referred to as Robo Advisers) that offer similar services.

See Article: Why I Put My Last $100,000 into Betterment

On this page, I’ll keep you up to date with quarterly results, and we’ll also learn more about how Betterment works, and investing in general.

Show Me The Money!

(results as of May 2025 – including dividend reinvestment and after fees)

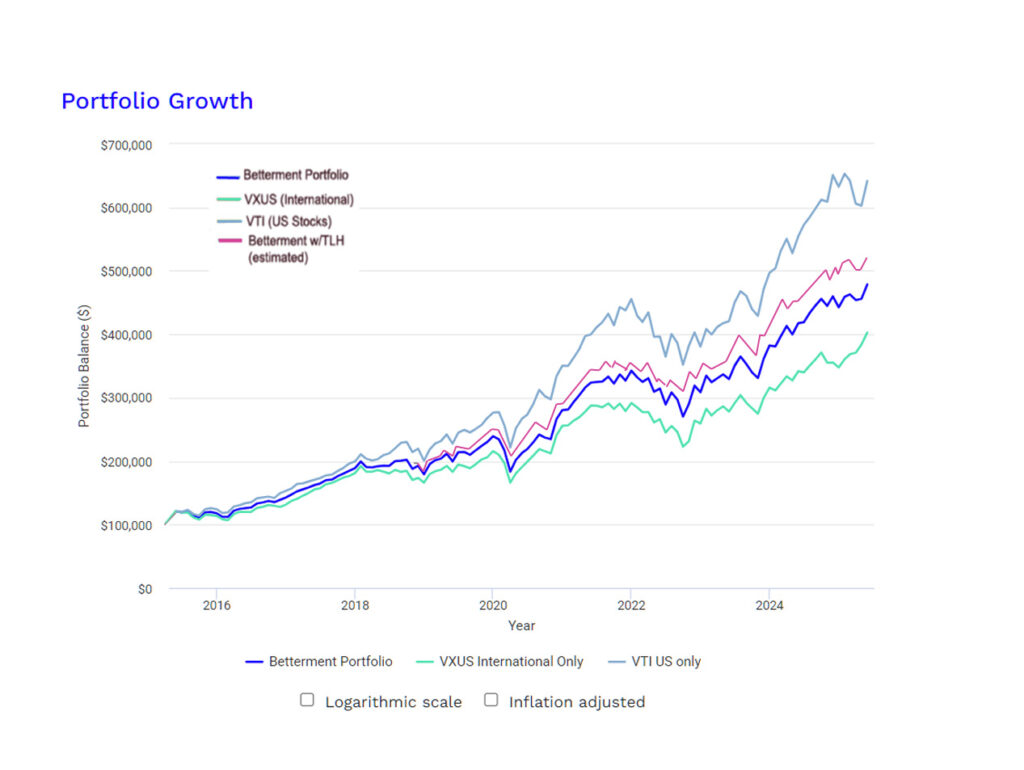

The blue line in this handy graph shows the results of my real investment at Betterment. I started with $100,000*, and am allowing them to suck in and auto-invest another $1000 from my bank account every month as well as reinvest all dividends, to simulate a pretty typical scenario.

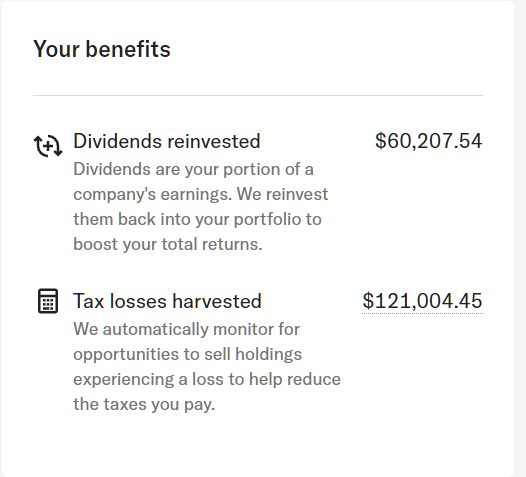

The purple line is my best estimate of my own benefits from Betterment’s tax loss harvesting feature. That depends on your own individual tax situation, but so far I have seen over $121,000 of “tax losses” harvested from this account, which at a marginal tax rate of 40% (state+federal) has added over $48,000 of benefit to my account value which compounds over time (see below), which would bring that line much closer to the top.

The top (grey) line is what would have happened if I had followed the same investment pattern with entirely US stocks through Vanguard’s excellent VTI Exchange-traded fund, and the bottom line is the same scenario if I had bought Vanguard’s equally excellent “Everything Except the US” fund, which goes by the ticker symbol VXUS.

This should help put the 2018, 2020 and 2022-2023 market declines into perspective, which all generated a lot of scary headlines in the financial papers involving the words “plunge” and “worst ever”. This is because newspapers make money off of scaring you, while in fact there is nothing scary at all about a buy-and-hold index fund investment.

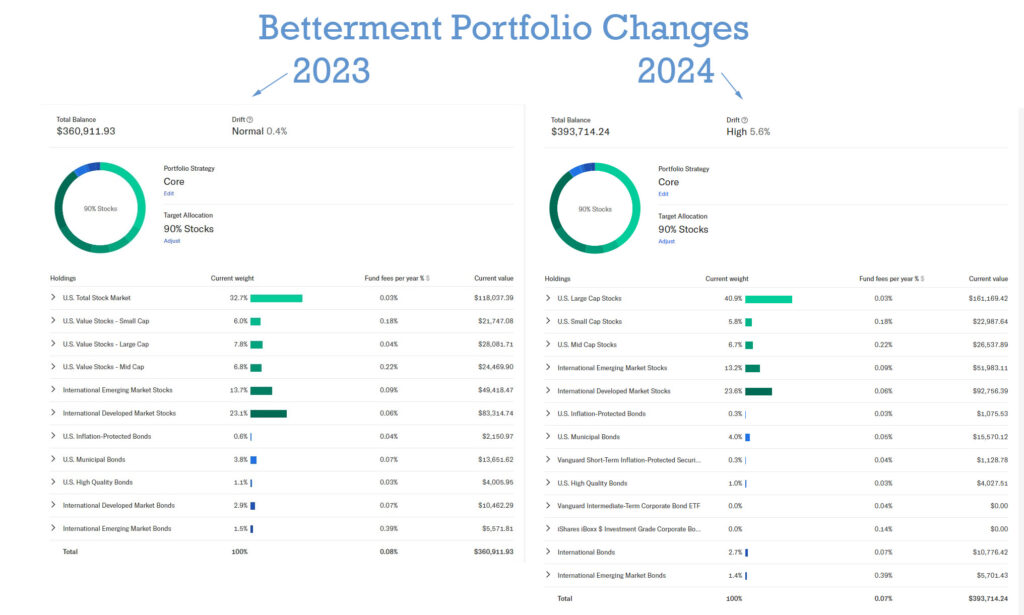

New in 2024: Betterment (slightly) Tweaks the Portfolio

Over these first ten years, the Betterment portfolio has fought an interesting battle: US mega cap stocks (like Apple and NVidia) have gone crazy and outperformed both the rest of our economy, and the rest of the world. Meanwhile, bonds have had a slow decade, due to low interest rates. This has handicapped the Betterment allocation relative to a hypothetical helping of purely US stocks. Fighting these macroeconomic trends on the positive side, Betterment’s tax loss harvesting and rebalancing has partially made up some of the difference (see below for details on that harvesting).

In January of 2024, Betterment made a slight change to their default portfolio, going a bit more all-in on the pure US index and reducing the “value tilt”. Here’s a screenshot of my account’s allocation before and after this change (click for full image):

I also spoke with some of Betterment’s investment management team after this change, who explained some of the other benefits of the new allocation. In short, not only does it bring the portfolio back into line with their original investing goals, but a drop in underlying fund expense ratios also allows for even better potential tax loss harvesting in the future.

Moving back to our regular programming, here’s my account’s performance since the beginning:

A recent screenshot of my “performance” tab. Note that I took out $95k for a charitable donation in late 2020, then replaced exactly the same number of shares when I had the cash in September 2021 (by that time the same shares cost me $135k – another great illustration of why you should always stay invested!)

Why do I think this is a good strategy?

In one word: Simplicity. OK, maybe we could add a second word to that: Efficiency.

After twelve years of writing this blog and hearing from readers of all types, I find that the same question keeps coming up: “What is the single step I can do to get started in investing?”

With no knowledge at all, most people default to keeping their money in a savings account where it will earn them nothing. Others resort to a Wild West financial adviser whose claims and fees exceed his actual financial knowledge. Or speculate in individual stocks and try to time the market. None of these approaches are winners over the long run.

To combat this, I’ve always said “Just buy the Vanguard Total Market Index fund (ticker symbol VTI).” That gives you a near-optimal ownership of hundreds of companies, in single giant, stable, low-fee fund run by an honest company. Over time, this single investment will outperform over 90% of financial advisers and other funds, while letting you sleep well at night.

To improve on VTI, you need to soak up a few more books about investing, general world finance, and asset allocation. And while this has always been my idea of a good time, I have learned that many people have other ideas for their weekends. And even those of us who read these investing books (myself included) often fail to execute the principles properly and consistently.

Betterment combines the (slight) advantages of more advanced investing, with an even simpler experience than you would get with just buying shares of VTI. The worthwhile things they provide, in my opinion, are:

- tax loss harvesting (see below)

- automatic tax-saving coordination between your standard and retirement accounts with Betterment

- really good tools to show you things like, “how much tax would I owe if I sold these shares right now?”, “how much income would my portfolio generate if I retired right now?”, and other useful visualizations

- a very sleek charitable giving system, which makes it easy to donate some of your appreciated shares – giving you a much bigger tax advantage than simply giving cash. More details on this in my 2017 charitable giving article.

In exchange, they charge a fee of 0.25% that is higher than just holding individual index funds, but much lower than standard financial advisors – and yet their investment methods are better than the average advisor, because many of them are commission-based, meaning they make money by steering you towards certain funds).

So in my view, Robo-advisors are a good way to invest for people who want things to run on autopilot.

Hey, my Betterment account [underperformed or overperformed] the US stock market! Why?

Welcome to your first two lessons on investing:

- Short-term fluctuations (under 10 years) mean almost nothing.

When investing for lifetime wealth, you need to think about longer time periods than you’re used to. It doesn’t matter what your stock does right after you buy it. What matters is the average price as you sell it off in increments much later in life – which could be 20-80 years from now. For example: Imagine that I went back in time to October 2014, but instead of getting started with Betterment, I bought $100,000 of stock in the video game company Electronic Arts (EA). As luck would have it, those shares would have closed out 2014 worth about $143,000. Does that mean EA is a better investment than VTI? No, it’s just more volatile. In fact, if you had bought EA in 2003 and walked away until December 2015, you would have earned zero returns for the entire twelve year period. The company has never even paid a dividend. Individual stocks are more volatile than the overall index, and yet collectively their returns equal that of the index. Which is a bad tradeoff in my opinion. - Your fancy new Betterment account contains more than just US stocks – over the long run this is a good thing!

The Vanguard fund VTI tracks the majority of US stocks. A Betterment portfolio tracks the majority of the developed world’s stocks. In recent years, the US S&P 500 index has been on a rampage, although mainly because of crazy overperformance of only the biggest and most heavily weighted stocks (Apple, Microsoft, Amazon, Google, Nvidia, Facebook, etc). And meanwhile, most European companies have seen solid earnings but lower stock price multiples. In other words, European stocks have been on sale. So my Betterment portfolio didn’t rise as quickly as the US market. At other times, the reverse happens: US stocks will fall dramatically, while other markets will fall less or even rise. On top of this, international stocks currently pay a much higher dividend yield. For every $100,000 of VTI you own, you’ll get about $1600 in annual dividends. For an equal amount of VXUS, you will get $2880, or almost twice as much. In other words, international stocks are priced at a much more attractive level than US stocks, which in my book is a time to buy.

How about that Tax Loss Harvesting?

One of the features of Betterment is that their computers spend all day looking at the stock market while you are off doing other things. Occasionally, this leads to an opportunity to profit from volatility in the market. Selling some of your stuff to lock in a tax-deductible loss, while buying very similar stuff through other funds so you remain fully invested.

Since I started this account, I have found that this feature works much better than I had expected. Take a look at this recent snapshot from my account :

Betterment has harvested a surprising $121,004 in deductible “losses” on an account with about $466k of taxable money in it.

The value of this is significant: a $121k deduction has saved me over $48,000 in income taxes already, which I have used to buy still more investments. If this $47,000 goes on to earn a conservative 7% ($3300/year), it is more than paying for the fees Betterment charges me (0.25% of $460,000 is over $1000 per year). Forever. And that’s just the passive income from these early years of tax loss harvesting. Then you also get to keep the principal you saved from the loss harvesting.

In other words, in my opinion Betterment costs less than nothing to use due to TLH alone, even before you factor in the benefits of the automatic reallocation, better interface, or other features.

The bottom line is that you save on taxes today but end up with investments which have a lower cost basis. This means you’ll have more taxable gains when you eventually sell them But for many of us, this is years down the road in retirement when we have ditched the full-time salary and thus are in a lower tax bracket.

How this works in practice: So when I file taxes for each year, I can take the Tax Loss Harvesting numbers from Betterment, and chop that amount off of any capital gains I made elsewhere that year. Sometimes those include profits from selling a rental house, or shares pf regular stocks that I sold to buy a new house, or up to $3000 against ordinary income. Betterment sends you a tax statement that you simply plug into your IRS tax forms, Turbo Tax, or hand to your accountant.

But this is not useful for everyone. For example:

- If you are using Betterment for an IRA rather than a taxable account, there is no such thing as Tax Loss Harvesting.

- If you are in a low income tax bracket right now, you might not have enough potential tax savings to make it worthwhile

- If your income ends up rising even after retirement (as has happened to me and many other early retirees), TLH might be counterproductive if you still have super-high income in the years that you are cashing out your Betterment account. (talk about Champagne Problems!)

- If you have other investments outside of Betterment with similar or identical funds, you might find the IRS disallows Betterment’s harvested losses. To prevent this, I hold different funds in my other accounts (I use Vanguard’s ESGV index fund instead of VTI – similar but different enough to avoid the risk of a wash sale)

Even with the caveats above, it is a cool enough feature – and profitable for many – that I left it enabled since the beginning.

This experiment remains interesting even after quite a few years, so I look forward to years of profits and analysis to come!

Note: To be clear on the background, I did not get paid to write this or any other post, but Betterment does advertise on this site. See the affiliates policy if you’re curious how I handle blog income.

* I chose an allocation of 90% stocks, 10% bonds, which you do by moving a simple slider control on the Betterment website as you set up your account.

Useful Resources:

The price and dividend payment history of VXUS and VTI, which I used to generate the spreadsheet to make the graph above:

http://www.nasdaq.com/symbol/vxus/historical

http://www.nasdaq.com/symbol/vti/historical

Portfolio Visualizer, a stock market analysis tool I really like, which I use to generate the comparison graph each time I update this article.

Tracy July 31, 2015, 1:18 pm

I am recently widowed and 54 yrs old. I am looking to invest life insurance money I received when my husband passed. I am very excited to find your information on Betterment investing. I have no experience with investing. This would be the first. I am confused as to the sliding scale you refer to about the ratio of stocks to bonds. I am still working and will probably do so for another 10 yrs or so. What would be the percentages of these two I would want to use to safely make the most I can given my late start in investing?

Døitashimashite August 20, 2015, 2:15 pm

Hi Tracy,

First, condolences for your loss of your husband. I’m sure this is a hard time for you.

Second, I apologize if this seems patronizing. You may be very capable right now, but I can only imagine how I would be in your situation. Seeing that you are a recent widow and inexperienced in investing, I would certainly recommend that you put the life insurance money in a SAVINGS ACCOUNT and leave it there for six months or a year while you deal with all the other responsibilities of rebuilding your life.

There is no reason at all to rush into investing right now. Even if the market was dirt-cheap (which is certainly is NOT) you would have a difficult time answering basic questions such as percent allocations to bonds vs. stocks without knowing more about things like budgeting, your need for security vs. income, and your financial and life goals. And of course these answers are bound to be guesswork until you know better what life will be like without your husband as a part of it.

Maybe you will get married again, maybe you will change to a new career, maybe you will move, maybe you will….. who knows? Imagining how my life would change if my wife passed away, I believe I would prefer just having a pile of cash rather than worrying about what the stock market will do. Then I would have time to learn about myself, and educate myself about investing. Good luck!

Moneycle August 21, 2015, 1:05 pm

Tracy, I think Betterment (or WiseBanyan) is a great place for somebody like you because it eases you into the process and automates the decision of how much to put into stocks/bonds based on your situation (it will ask you some questions to try to assess your risk tolerance).

While I agree with Døitashimashite generally, I also think it’s easy to get paralyzed by what decision to make. If you feel uncomfortable investing it all at once, try just putting a small percentage in to start and see how it goes. Another way to do it is to set up an automatic withdrawal. So maybe you could start with the money sitting in your bank and move 5-10% over every month. That way, if you get cold feet part way through you can stop the process and re-evaluate.

Remember, nobody cares more about your money than you. So keep learning and investing and you’ll be fine.

Moneycle August 21, 2015, 1:09 pm

p.s. this is a good resource for you: https://www.reddit.com/r/personalfinance/wiki/commontopics

Steve Adams August 10, 2015, 7:14 pm

Robo-results should be almost identical to a simple Vanguard fund portfolio, the difference being with Vanguard you don’t have to worry about what will happen to your investments during the next VC/ dot com bust.

JTB August 13, 2015, 9:34 am

Hi MMM, I am a faithful follower. Your approach to finance has changed my life. I rolled over about $45K into Betterment from Vanguard about 8 months ago. By mere coincidence, my allocation was the same as your own – 90/10. I understand that I am not receiving the same tax harvesting benefit; however, my return in the last 8 months has hovered between 2% and 3% and never exceeded 4%. Historically, Vanguard was about 7%. I understand that the long term horizon is what’s important, but over 8 months, I would have expected better. Educate me please.

Antonius Momac August 19, 2015, 2:49 pm

Hi JTB,

I actually already replied to somebody with my experience, but here it is and I want you to know that your gut isn’t leading you astray.

betterment vs. Vanguard IRA with 100% in the vanguard 2045 fund:

For Betterment, Sept 2013 – Oct 3, 2014, with a withdraw on that date. I received 2.8 % return, as per their site performance calculation.

During that year, I moved a few times between 50/50 portfolio and an 80/20 for a year. So I defiantly did something wrong.

It was about 20K in total, but I think I started small, then ramped up, and then settled in with a weekly addition of 40-60 dollars. I figure I’d do that dollar cost average deal and try out their tools.

But certainly, timing could have been a big factor.

I also have a vanguard account (IRA) with everything in a 2045 target date retirement fund.

for a similar time period:

Sept 2013 starting balance was 28,511.85

Sept 2014 ending balance was 33,189.72 (and this was a losing month)

No money was added by me in this time period to the Vanguard account (STUPID ME!)

the difference is 4,677.87 or about 16.41 % (return)

Not sure what the fees are, but betterment invest in funds with fees, plus adds their fees on top.

I must have done something wrong. But still 13% difference, I went back to put it all in Vanguard. Saved the betterment fees too.

The math doesn’t lie…

Dustin Stout August 16, 2015, 3:37 pm

Brand new to investing here. I went with Dodges suggestion of:

56% Total Stock Market Index Admiral Shares – VTSAX (3804 stocks across the USA)

24% Total International Stock Index Admiral Shares – VTIAX (5785 stocks across the world, excluding USA stocks)

20% Total Bond Market Index Admiral Shares – VBTLX (6948 bonds across the USA)

Question- Should I be in a life strategy fund, or is the above good enough?

Moneycle August 21, 2015, 1:52 pm

This allocation is just fine. It comes down to your personal style. If you want more control, keep these funds and rebalance once a year. If you prefer the simplicity of a single fund, Vanguard LifeStrategy Growth Fund would be pretty close to the same allocation and you wouldn’t have to rebalance.

Dustin Stout August 24, 2015, 9:24 pm

Thanks! My timing was impeccable, put my money in right before the market tanked :).

Oh well. Time to buy more.

Moneycle August 25, 2015, 3:32 pm

Oh, so it’s YOUR fault! :-)

TeriR August 24, 2015, 4:18 pm

After reading about Betterment, this site and other “versus” articles, I opened a Vanguard account. Pretty new to this, but I had around 200K in my savings account getting the low bank rates. I’m 37 and make around 3,800 a month after taxes.

(pending bank transfers)

First opened a Roth IRA and put a transfer for the max – $5500. Put a pending order for the Life 2040 fund.

Next opened an individual account and put a transfer for $50K. Followed Dodges suggestion:

56% Total Stock Market Index Admiral Shares – VTSAX ($28K)

24% Total International Stock Index Admiral Shares – VTIAX ($12K)

20% Total Bond Market Index Admiral Shares – VBTLX ($10K)

So after everything gets put in, what do I do next?

Set-up a monthly withdrawal from savings ($500 a month or more?) and put in the individual account?

After the money gets it, does it do it automatically or do I have to allocate it?

Perhaps I missed the setting in Vanguard? Any help is appreciated.

Moneycle August 25, 2015, 3:46 pm

Periodic investments are a great idea.

It’s pretty easy to set up an automatic deposit. Go to My Accounts -> Account Maintenance -> Automatic Investment to set up how much you want to move over every month and where to invest it.

Vanguard also has an IRA investment option where you can tell them to invest the maximum allowed every year and they will figure out how much that is every month (or whatever period you want) and deduct the correct amount so that you max it out each year.

Regarding your investment, since you follow Dodge’s allocation, the onus will be on you to rebalance it occasionally (once/year is enough). If you had chosen to invest in a fund like a LifeStrategy or Target Retirement fund then they would do that for you so you might consider if you’d like that sort of convenience. In your case, the LifeStrategy Growth Fund (VASGX) has a pretty similar allocation:

50% Total Stock Market

30% Total International Stock Index

15% Total Bond Market

5% Total International Bond

But that’s just me… I like convenience. There’s absolutely nothing wrong with Dodge’s allocation.

Nice Joy September 5, 2016, 6:12 pm

Can you change the allocation later if you select target retirement fund ?

Nice joy September 7, 2016, 10:29 am

ER for life strategy fund is higher than admiral shares

Amanda August 29, 2015, 8:05 pm

Hi all.

My job offers a traditional pension plan, which has a mandatory contribution. In addition to the pension plan, we also have options to invest via 401k, 403b & 457b. If we chose to invest in any of these, nothing is matched. I’m interested in saving/investing and plan to retire early, so my question is: 457b or something like Vanguard or Betterment? Like most of the folks posting on here, I’m completely new to the investment game and could use some schooling.

Thanks in advance for any insight you can offer!

Amanda

Moneycle August 31, 2015, 12:23 pm

I’ve never heard of an employer offering all of those plans before. Typically 401k is for private sector, 403b is for non-profit, and 457b is for government. If you really have choices for all 3, I can’t help you decide which is the best to choose. However, I would recommend you invest in one of those plans before investing outside.

Here’s a link about how to prioritize the next dollar of investment: http://www.bogleheads.org/wiki/Prioritizing_investments

Jibba December 27, 2016, 9:28 pm

Amanda,

It sounds as though you work for a state agency, school, hospital, etc. Basically, you have the best and ultimate savings situation available, as you have the maximum tax-advantaged space with which to invest.

The 401k and 403b will be treated as the same “bucket” in which you can add $18,000/year. The 457b account is a special account available to government employees wherein you can add ANOTHER $18,000/year pre-tax, as it is considered an “un-qualified account” by the IRS, and therefore not regulated by the same ERISA regulations (ironically the Gov never plays by the same rules that it creates for others). The 457b account is also available to withdraw from at ANY AGE without penalty as in a 401k. 457 Plans also tend to have lower fees than 403b/401k plans.

My suggestion is to prioritize your savings by adding to the 457 plan first, putting everything you can into the cheapest large company index fund available (normally Vanguard or Fidelity 500 funds). You can add 10% into the total bond market index fund if you want less volatility, but really this is not necessary for anyone under the age of 50 and still accumulating wealth.

Once you put in your $18k for the year, you can look to add any money left to either the 401k/403b, or a personal IRA account. Do the IRA if you qualify to deduct the contributions. Use the 401/403 accounts if you make too much for a TIRA deduction. 401k’s have better regulations than 403b’s, but it depends on the fee structure.

In all accounts look for a total stock market index fund, or a 500 index fund to put your money, and forget about it.

galivantstom August 29, 2015, 8:55 pm

Presently, I’ve been doing my investments and know a bit, not a lot about investing. Presently, 2/3 of my IRA is in a variable annuity. Huge mistake. I’m 68 and it looks like my account will run out when I’m 81. Based on family history I stand to exceed that age. The other 1/3, $100,000 or so is in a mixture of stocks and two funds. I’ve decided that its time for me to pull out of managing my investments. At any rate, I expect to be able to leave the $100,000 alone for several years. That being said which would be the better route for me to go: Betterment or Vanguard?

Moneycle August 31, 2015, 12:06 pm

That’s quite a pickle! Doesn’t your variable annuity pay income for life? Why would it run out? Will you take social security at age 70?

Honestly, the most income you will be able to draw from your $100,000 would be to buy a Single Premium Immediate Annuity (SPIA). In my research, the SPIA is the only “good” annuity. As you have found out, variable annuities have lots of complexity and costs that make them very profitable for the insurance companies. SPIAs however are very simple in that, you give the insurance company money and they give you back guaranteed income as long as you live. Some people call it “longevity insurance” because it will pay you no matter how old you get.

I think this is good for somebody your age (and older) because at age 68, you would probably get around $7000 (7%) of income for the $100,000. And if you wait until you are 75, you might get as much as 9%. There’s no other investment that will be able to match that because you generally wouldn’t want to draw down your investment by more than 4%.

The reason insurance companies can do this is because they are pooling the risk with other people your age. Some will die early, some will die late. Hopefully you will die late and get more than your share of the pie.

But you shouldn’t take advice from some random guy on the internet. You probably ought to try to find a “fee-only financial advisor” (google that) who can give you objective advice for your situation. They might be able to help you with other ideas to generate income (maybe a reverse mortgage?).

Mike September 29, 2015, 1:20 pm

I am on the fence to go with Betterment but I think given your info I will go for it and move our money over. Right now I use TD and all of the Vanguard ETFs are no commission so it’s not costing me anything. BUT, the manual process and having to divide up my monthly investment is a pain and using Betterment to automate DOLLAR COST AVERAGING with ETFs (not an easy or possible task compared with index mutual funds) seems to be a good selling point too and the fee they charge is a small price to pay. Thanks for sharing your results. Are you still happy with Betterment?

MidSizedKahuna October 5, 2015, 2:25 pm

Just curious how Betterment performed during the recent downturn and “flash crash”.

What are your thoughts on inherent instability in ETFs and recent hedge fund moves such as double shorting and front loading ETF trades?

Marc October 6, 2015, 1:47 pm

MMM-

After having read articles here, Mad FIentist, and Collins blogs, I am now – finally – moving my savings to either Vanguard or Betterment. I have come off of long calls with both organizations. I will be investing significant sums of money into either. A couple things that I have learned (that may be helpful to others here), neither organization will pick up the tab if your present money manager charges you to to close your accounts. Separately, Betterment charges 0.15% on top of the ETF fees (at $100,000 invested or above) where as Vanguard charges 0%. Vanguard does offer a similar service to Betterment and charges 0.30% for it (portfolio management + tax loss harvesting + re-balancing).

So my question..MMM, as I am now taking my investments under my wing (after having 3 poor experiences with Morgan Stanley, Merrill Lynch, and now RBC invesment managers)…if you were investing upwards of $1m into one Betterment/Vanguard and most of that money is NOT in a tax-shielded vehicle, like an IRA, which way would you go: Betterment or Vangaurd? And if you say the latter, would you put most of the sum into the VTSAX (no need to put into VTI as VTSAX expense ratio is 0.05% at the Admiral level)? This investment represents a significant piece of my overall personal portfolio.

Thank you.

steve October 7, 2015, 5:30 am

MMM thanks for the update again, I’ve been intrigued. My wife and I are ready with sufficient savings to have a buffer, and start investing.

Question: with VTI trending at about +5k as of October 5th (and as early as July) would Betterment still be recommended if evaluated based on the returns? Certainly there’s more to consider in straight Vanguard vs Betterment, but a 4% difference in performance is not insignificant (at least to me).

Thank you!

Mr. Money Mustache October 9, 2015, 6:03 pm

Hey Steve.. someone else asked a similar question recently, but if you check out the article you will see the answer: one year is WAY too short a period to judge returns.

Betterment is effectively a mix of US and international stocks. This year the US has hit a home run (booming economy and zero interest rates), while Europe has had a financial crisis. So their stocks dropped more. They are effectively on sale right now, and so it is the time to be buying more. With a Betterment portfolio, this is happening automatically as they allocate more to the cheaper International stocks. Come back in 5-10 years and we will see how things look!

Joel Maher October 7, 2015, 2:12 pm

I see that VTI is 5% more efficient in the last year than Betterment for you. We have experienced enough down markets to harvest serious losses, are there other gains which offset the 5% difference that you see at tax time? I would like to see the total 1099 statement (or at least realized gain/loss) to help understand this better.

John N October 10, 2015, 4:20 am

So, you started with 100k and put 12k in over a year and ended up with 112.67k. Isn’t this like 0.6% per annum return on investment?

snowcanyon October 24, 2015, 2:53 pm

Interesting! I have been considering moving my money to Betterment, but the tax loss harvesting conflicts with the only decent fund in my 401k. There just isn’t a way around the wash-sale rule for my particular situation. With the crap options in most 401ks this is probably not an insignificant problem.

I thought about perhaps switching to Betterment after ER because the 401k issue will then be moot, but at my projected income level I will want, like most early retirees, to tax-gain harvest, not TLH. Betterment cannot, of course, do TGH because they do not track each client’s taxable income.

MMM must be doing extremely well in retirement to aggressively pursue TLH as opposed to TGH. Congratulations and more power to you!!

scott November 19, 2015, 10:06 pm

Thanks MMM,

I’ve only stumbled upon your page this morning, and I’m well on my way to becoming an ‘avid reader’ as they say.

I agree with the Betterment concept (and have opened and funded a Betterment account in the last month), but I’m struggling to find a way to compare Betterment directly to stocks, market indices, index funds, ETF, Mutual funds, BRK.B, etc. Part of this comparison would be to justify selling those other equities I already own (at least a portion) and shifting to Betterment.

I realize this is complicated by the fact that Betterment allows the Stock/Bond % changes, but is there any way to get Betterment’s historical data (doesn’t have to be my specific account data) on the same graph? This would be even better if it was possible to extrapolate Betterment’s investment programming to historical data for the past 10-20 years?

Regards,

Scott

DanielB December 8, 2015, 12:23 pm

MMM, and anyone else that’s feeling helpful,

First time reader…ended up here after researching what I could be doing differently in my Betterment.

After reading all the comments, my question is this:

I’m mid 20s, married, bought a house last year (in a good market), good job, and my wife’s in school to make a lot of money later, but I support her for now. I have a comfortable amount in liquid savings for emergencies (not a ton, but I add to it when I can), and a good 401k (vanguard target mostly) with matching that I’ve been happy with.

What I don’t know about is the mid-term. I have about 15k (plus ~$300/month) that I’m not planning on needing for 5-10+ years that I’d like to grow as much as possible (I’m OK with more risk depending on the reward) – ideally used for a house upgrade, start on kids-to-be college fund, traveling later in life, or similar. This, and the $300/month auto deposit, is currently in Betterment at 85/15 stock/bonds.

Is this the best thing I can be doing? Any other suggestions for my current, or future financials?

Thanks for all the help!

Daniel –

Dōitashimashite December 9, 2015, 7:01 pm

Hey Daniel! Congratulations of having your stuff together while pretty young.

I’m going to point you to Scott Adams (of Dilbert fame). He wrote a latest book “The Way of the Weasel”. This is his 9-point financial plan. Perhaps there are some gaps for you to fill in.

This is the plan:

1. Make a will.

2. Pay off your credit cards.

3. Get term life insurance if you have a family to support.

4. Fund your 401k to the maximum.

5. Fund your IRA to the maximum.

6. Buy a house if you want to live in a house and can afford it.

7. Put six months worth of expenses in a money-market account.

8. Take whatever money is left over and invest 70% in a stock index fund and 30% in a bond fund through any discount broker and never touch it until retirement.

9. If any of this confuses you, or you have something special going on (retirement, college planning, tax issues), hire a fee-based financial planner, not one who charges a percentage of your portfolio.

If you want to be hard-core, I’ll add some addendums to the above numbers. Do these as well!

1. And all the health and legal proxy stuff, read anywhere about wills and there is a whole bunch of other stuff you can do to help your loved one.

2. Yes, and stop using them!! You pay much more and are less impressed (and impressive) with the amounts than if you use cash, baby!

3. Get a LOT while you are young, it’s cheap. Like a million per person. And don’t forget short-term and long-term disability. Our family has used them!

4. You seem good here! Do you work for yourself? Look into a SEP-IRA.

5. ROTH at $5500 per working individual, do it!

6. You should try to have at most a 15 year mortgage. Yes, pay it off until there is no PMI, pronto!

7. There are savings accounts that pay 1%, which is good nowadays. But it makes my wife VERY happy to see a local bank where we can stop in and withdraw tens of thousands on the spur of the moment if we ever REALLY need to.

8. Eh, bond funds, they suck right now. You could hold cash…. it’s supposed to be safe, after all, more than make money. The 30% is so you can scoop up cheap stocks when they crash like 2009 and you can buy before the market triples in 6 years.

9. I personally prefer educating myself, but your interest level may lean in other directions.

Anthony December 11, 2015, 9:35 am

Dodge et al – thank you for some great information and strategies. I’m not a newbie, and have worked with Money Managers (unfortunately) for 15+ years. All they have done is take money from me with poor performance and empty promises. I came upon MMM in doing research for Betterment as I really liked the concept, but in reading Dodge’s suggestion of the buy and check once a year portfolio, that sounded even better especially after the fees I’ve been paying to MM’s all these years.

56% Total Stock Market Index Admiral Shares – VTSAX (3804 stocks across the USA)

24% Total International Stock Index Admiral Shares – VTIAX (5785 stocks across the world, excluding USA stocks)

20% Total Bond Market Index Admiral Shares – VBTLX (6948 bonds across the USA)

Some questions though. My $$ is in mainly Schwab right now and I’d hate to have to move it to Vanguard, but if that’s what has to be done, I guess that is OK. Does Schwab have equivalent funds/fees?

Second q – does this same strategy apply for retirement accounts as well?

Thank you all – great info.

Anthony

Dōitashimashite December 12, 2015, 11:19 am

Hi Anthony,

Schwab is an excellent broker. They have $0 fee Schwab ETF OneSource funds, which I’d recommend as similar Schwab funds have lower fees. Compare:

SCHB Schwab U.S. Broad Market ETF 0.03% fee vs. VTSAX 0.05%

SCHF Schwab International Equity ETF 0.08% vs. VTIAX 0.14%

SCHZ Schwab U.S. Aggregate Bond ETF 0.05% vs. VBTLX 0.07%

Either way you go should be good, it’s not a huge difference.

Yes, same strategy for retirement accounts.

Anthony December 31, 2015, 9:54 am

Thank you Dōitashimashite. OK so I have officially broken up with my money manager. Now what?!?! Most of my money is in equities. When do i start selling? Do I do it all at once or over time? Do I put everything to cash and just dollar cost average over a year or 2? Appreciate any insights!

Happy new year!

Anthony

Dōitashimashite January 5, 2016, 10:23 am

Happy New Year Anthony!

Assuming these are in cash accounts rather than IRAs, you have to consider tax implications. If they are in IRAs or other tax-protected kinds of accounts, you can sell without worrying about taxes.

These questions probably need more personal information than we can discuss on a forum. I’d be glad to assist more if you would like to email me at adamhargrove at yahoo.com

Isaiah December 12, 2015, 2:40 am

Hey guys,

Now I’m pretty new to investing as I am twenty years old, and maybe I just don’t understand how this works, or maybe I really really suck at math?! I don’t know, someone on here will let me know hopefully.

But if I do the math on how much you started with, $100,000.00

And add the “monthly buys”(I assume is already your money in your bank account)

+$12,000.00

=$112,000.00(of your own dollars?) and…

$600 and some odd dollars of gains?

I understand that at $600 you are making money, but I don’t feel like if I add $600 to my account every year that I’ll be able to comfortably retire until I’m…(now please check my math, but say $80,000/yr for 30 years) I would have to get this kind of return for 4,000 years.

Can somebody more intelligent than me explain how this works because I know investing works, I just feel stupid right now and this is going over my head.

I just don’t think healthcare is going to advance far enough to keep me alive for that long…

And all of this Is based on me, at twenty years old in college, having 100k in an account already.(I don’t, In case anyone was wondering)

Thanks for any help.

Mr. Money Mustache December 12, 2015, 8:33 am

Hey there Isaiah, we might be at a perfect time to do another article on stock investing in general. The quick answer for you is: my account is not currently showing a major gain because the STOCK MARKET has made any major gains in the past year. Which is a totally normal thing, because one year is far too short a period to consider!

Some years you will see a 25% gain, other years a major loss. In fact, occasional brief drops of a full 50% – fully HALF your money – should not be surprising. It is only in periods of 10 years or more that things start to become consistent and extremely profitable for us investors.

So, just keep earning a lot, spending very little, and buying as much low-fee index funds via Betterment or Vanguard as possible.

Isaiah December 13, 2015, 4:39 pm

Mr. MM,

That is how I thought things worked, I want to invest towards 40 years from now and in no way do I expect every year to return a good percentage. I just did not think this year was that bad I guess.

Would you recommend Betterment to somebody with only a few hundred per month to invest over any other route or company?

And am I right in thinking that now, and over the coming months and years is a good time to buy because things are low?

Thanks so much!

Scott December 14, 2015, 6:43 pm

clap….clap….clap…clap.

I just realized why you would write such an in depth article about this and share it with your reader base. I mean, I believe you believe in it, but the frugal side of me wondered why you would spend slightly higher fees for betterment. Then, after I signed up and referred three of my friends to get my first year free, I started developing a plan for me to never have to pay ANY fees with Betterment for the life of my account.

That’s when I realized, you must have accomplished this. With your reader base, you must have hit that many referrals no problem at all. Brilliant. Absolutely brilliant. Makes me love your advice even more.

I hope to be able to attain a fee free investment account myself, but I think I’ll have to work awhile longer at it!

Mr. Money Mustache December 14, 2015, 8:57 pm

Haha.. thanks for that slightly cynical compliment Scott :-)

I don’t actually get referral bonuses on my account, so I’m paying the Betterment 0.15% fees just like normal people. I chose to do this because I think the value they provide is greater than the fee they charge (for example they saved me over $3,000 in income taxes in 2015!)

The way it works is this, as disclosed in the post: I put my personal money into Betterment, but signed the BLOG up as an affiliate. The blog (wholly owned by my company) gets a small commission if people start their own Betterment account. In theory, this benefits “me” although my goal is not to spend money this blog earns on my own lifestyle.

You, however, can probably get free Betterment fees if you continue to be a great spokesman.

Scott December 14, 2015, 10:37 pm

haha I apologize, I didn’t mean to be so cynical. Obviously you write all of these blogs because you’re passionate about saving money and helping others do the same, I didn’t mean to say you specifically wrote this post to save money on Betterment :p

I was actually more impressed than anything else, and I’m glad that you get an affiliate fee – as you should! Whether its referral credit or affiliate pay, you are bringing them more customers and making them money, so it’s only fair they give you a cut.

I have to say, after re-reading through these comments and taking in some more information, I think that once my year and a half of referral credit is up I will be very seriously considering taking my account straight to Vanguard. As many have mentioned, that’s where your money ends up anyway. However, I very much value your opinion and if you are in it for the long run I don’t see why I shouldn’t be as well.

I hope to have about 20-30k by that time (still early on in my investments), and at that point hopefully I can come to a conclusion that I will feel comfortable with for my wife and I’s money.

Thanks so much for all your advice, and your proactivity even in the comments!

Brendan December 15, 2015, 11:22 am

Please explain. You can only tax loss harvest $3000 per yr.So I thought the most you could benefit would be $3000 x your top tax bracket.

Mr. Money Mustache December 15, 2015, 2:28 pm

Hi Brendan, I believe that $3000 number is the limit you can deduct against ordinary income. If you have other capital gains in your life as many investors or early retirees do (for example, selling of index funds to buy groceries or the $100k tax gain I booked in 2015 from selling a rental house), your harvested losses can be used to offset those.

But your point is a good one – for your average Mustachian simply working a full-time job and saving a load of it into index funds, the benefit of tax loss harvesting tops out at $3k/year. But you CAN carry any unused losses forward forever until you eventually use them up: https://www.irs.gov/publications/p550/ch04.html#en_US_2014_publink100010729

Scott December 20, 2015, 9:45 pm

Sorry if this is a stupid question, but does Vanguard offer a robo service line Betterment or Wealthfront? I’d love to be able to get all Vanguard funds/ETFs in a robo service run by them. As an alternative, I’m looking at Schwab’s robo service, although Vanguard is my first choice.

Antonius Momac December 22, 2015, 10:57 pm

Scott,

I think that’s the idea behind target date retirement funds. I think they match robo funds with less expense.

portlandia December 22, 2015, 4:36 pm

Hi MMM,

My question is regarding ETFs in general – they appear to be here to stay, and I utilize them myself in investing, however, a question that has always bugged me is: ETFs are still essentially derivatives, correct? Is there any language buried in the prospectus that is scary to anyone about what owning an ETF really means (or doesn’t mean)?

Because ETFs can be very tax-efficient vs. most mutual funds or SMAs, I expect the trend will continue that more and more people will use these robo-advisor services to save for retirement, which means more and more money owned within ETF-land. Are there legitimate concerns that this could lead to new problems in market liquidity/solvency at some point?

Finally, if an account is opened at Betterment, where is the money custodied and is there a custodial statement provided?

Thanks!

~ portlandia

Dōitashimashite December 23, 2015, 11:23 am

Hi portlandia,

I’m going to try to answer your questions which are good ones!

First, what is an ETF? They are basically a two-step investment, where large broker-dealers trade large blocks of shares called “creation units” which are bought with the actual underlining stock. The broker-dealers then in turn become market makers to us small investors, trading individual shares of the ETFs back and forth to each other. If more small investors want to buy than sell, the price will increase above the NAV (net asset value) and then the broker-dealers will have to create more “creation units” by buying the actual companies again, forming ETF shares, and releasing them into the market.

So… does that make ETFs the same as derivatives? Derivatives are basically “bets”; contracts between two parties to pay off if some (future) event does or doesn’t happen. Futures and options are the ones I’m familiar with. For example, by buying a call option, I can bet, say, Apple Inc. (currently $108) will not lose value below $105 by Jan 19, 2018. I can find a seller to place the bet, and if Apple goes over $105, I have the right to “call” the stock, i.e. buy it from the seller for $105 per share. If I’m right and Apple is still $108, I’ve made at least three bucks. If I’m wrong, the seller keeps the stock. Of course, this bet isn’t free; today it cost $18.86 (last traded price). So in fact I need Apple to go to $105 + $18.86, or $123.86 to make money.

This is a raw bet; neither the buyer or the seller of an option has to actually own the stock. The option exchange market Chicago Board Options Exchange handles the trades and money.

One can argue ETFs aren’t derivatives, in fact as an EFT owner you never touch the shares, you don’t get voting rights. But the ETF “creation units” do buy and sell shares. With derivatives, you don’t have to touch the shares either, but you can if you want to. Now, for even more complexity, you can trade options on ETFs, and there are ETDs, which are ETFs of derivatives.

I like to compare this to when the dollar was on the gold standard, you could walk into a bank and trade a dollar bill for so much gold. You can’t anymore; but you can buy gold if you want. Is it the same thing? Is the dollar somehow “fake” if you can’t ‘back’ it with gold at the bank, even though I can buy gold online? Do I even want to?

Will ETFs someday be freely exchangeable for fractional shares of a thousand companies? Maybe. Will anyone care or actually do this? Probably not.

Anyway, this are my thoughts! Hope it helps.

cynthia December 28, 2015, 1:35 pm

Love you, you generous post-ers!

My life did a big Do-over, put me in a tight spot financially, and want to squeeze in a new account before year’s end:

So here I am, single status over50, freelance painter earning 35-50K a year,

no debt or huge expenses but only $12k in regular savings at this point (though

I have the potential to save more going forward).

I know. A bit of a tight spot. :) Keep going and try to make smart choices, I’ll be fine.

So. After reading the above posts, I’m onboard to use Vanguard, just wondering…

Maybe max a Roth IRA every year and start a Life Strategy as well? Or is a Roth IRA

too late to start at this stage?

Appreciate any perspective on this,

cynthia

Dōitashimashite December 28, 2015, 8:36 pm

Hello Cynthia,

Yes to the Roth IRA. Also, as you are freelance (self-employed), you may want to consider the advantages of a SEP-IRA or SIMPLE-IRA. You can do these along side the Roth!

http://www.fool.com/money/allaboutiras/allaboutiras04.htm

https://investor.vanguard.com/what-we-offer/small-business/compare-plans

And don’t forget the double tax benefits of contributing.

https://www.irs.gov/uac/Save-Twice-with-the-Savers-Credit

And at your age it is certainly NOT too late to save, with increasing lifespans you may live another 40-50 years.

cynthia December 29, 2015, 9:23 am

Dear Dōitashimashite,

I have to admit my eyes welled up…many thanks for your thoughtful response. :)

I have pored over the links, and am now in process of making something happen!

And special shout outs to Dodge and MMM, your older posts were influential in getting me here.

The kindness and generosity of strangers is not celebrated enough. Woo hooo!

Warm Regards,

cynthia

Dōitashimashite December 30, 2015, 12:47 pm

Wow, cynthia, I’m honored. If you have any trouble at all, you can email me at adamhargrove yahoo.com

Julie December 29, 2015, 4:48 pm

I’m in my early 30’s and have $250k to invest. I’m currently using a financial advisor (with a 1.2% fee). Do you think I’m better off with betterment or a financial advisor?

Dōitashimashite December 30, 2015, 12:07 pm

I would argue, yes you will most likely do much better doing it on your own. You are now paying $3000 per year for your financial advisor’s services. Did you “beat the market” by that much, or somehow get that much help? How has your advisor done historically, over the past say 5 years or since the crash of 2009?

Personally, it is not that hard to do it yourself. For your level of funds, I wouldn’t recommend Betterment (which would charge you $30/month, or $360 annually), I’d recommend moving the money to TDAmeritrade or some other discount broker and just buying Vanguard funds with the money for FREE. You can do a lot worse than 50% VTI – Vanguard Total Stock Market ETF and 50% BND – Vanguard Total Bond Market ETF, and TDAmeritrade will current pay you $500 to transfer the money over.

Any questions (or anyone else reading this), you can email me at adamhargrove yahoo.com

Ken January 5, 2016, 8:48 pm

Dodge,

Is there a way I can contact you privately to get advice? I can pay for your time. Your advice on this thread has been nothing short of amazing.

I am moving assets out of a high fee private wealth advisor and would love to get your thoughts on what to do.

Thanks.

Jose March 9, 2016, 9:40 am

Ken — any word on moving your funds away from your private adviser? Tax issues, etc.

Dave January 11, 2016, 9:46 am

Hey everyone,

I am trying to make some decisions about my current accounts with Vanguard.

I’m wondering if anyone has looked into http://www.futureadvisor.com. They offer a paid service where they will reallocate funds through my Vanguard account…OR…you can see their advice and make the changes on your own for free.

I have done a bit of that, but don’t feel 100% comfortable because I am taking advice from a somewhat unknown entity. I see the reasoning and rational behind their recommendations….but I’m curious if anyone has looked into that service to track their performance or something along those line.

In the end I’m trying to decide about a move over to Betterment vs. sticking with Vanguard and making investments based on advice from Future Advisor

Thanks!

Mr. Money Mustache January 11, 2016, 12:20 pm

Hey Dave, I have looked into Future Advisor a bit too – they are a solid company based on some good principles.

Tony W January 12, 2016, 8:09 am

It feels like Tax Loss Harvesting would help maximize the Roth Ladder that I intend to take advantage of. Any thoughts on that?

Dōitashimashite January 13, 2016, 11:46 am

Only that there is no tax-loss harvesting for ROTH IRAs, as ROTHs pay no taxes in the first place. If your ROTH loses money, that’s that.

Elizabeth January 14, 2016, 10:43 am

Hi! My husband started reading you and asked me to do some research on index funds because he is 100% convinced they are the way to go.

For background my husband and I are both 30, make about 100,000 a year combined, and bought our home 2 years ago. We are both really into savings so manage to save about $2,000 a month cash plus our IRA and 401k contributions. We recently got a large inheritance from a relative and we need to figure out what to do with it.

So, I have a few questions.

Everyone talks about index as being the right choice for long term. If we are planning to start our own business in 5 years would you consider putting the money somewhere else?

My husband contributes the max to his IRA each month and I have a 401k with my company. It doesn’t match but does put in 3% regardless of if I contribute. Would you suggest we stop paying into those and put that money directly to an Index fund each month?

Shawn January 14, 2016, 12:00 pm

to mmm…..

So i see that you chose to invest in Betterment and although you didn’t mention it, you inadvertently chose not to put that same money into personal capital. Is the reason simply because the fees are less than half the cost? It sounds like the betterment people rolled out the red carpet for you a bit because of your celebrity blog status. The difference for us commoners in the investment world is obviously that we are entering into a completely automated situation with betterment. On the contrary with personal capitol they educated me substantially about all aspects prior to investing. They seem to have a degree more power to the punch with regard to the people that make up the company. the theory that they both operate under seems very similar in theory but with a few differences. It sounds like betterment only uses vanguard funds and etf’s? Additionally, after your account surpasses 100,000 instead of using etf’s as betterment does, mostly individual stocks will make up your portfolio at personal capitol. So your allocation can get more efficient and transparent and where an etf has a expense to it, individual stocks do not. When you add the etf expense ratios at betterment it closes the price difference a bit between the 2. Although personal capital is more at .89 percent to me it seems like maybe its worth the added fee? This is all a result of my due diligence in the past week since i am looking at moving my 100,000 roth over to one of them. Sure i could manage myself with my new wisdom from mmm and other recent sources however , i have to be honest I’ve done poorly managing the money historically. Also, i can expedite my learning curve with personal capitol and i can always take the reigns back later in accordance with my future arrogance. pls let me know some opinions?????

Mr. Money Mustache January 16, 2016, 11:57 am

Hi Shawn, great question as I have also written about Personal Capital.

First of all, I got no “red carpet treatment” from Betterment – I have a normal account and pay the standard 0.15% fee. No advice from anyone (although I love Dan Egan’s occasional articles on economics and behavioral finance on the Betterment site).

Secondly, I don’t like talking to people about investing – I learn better through reading. So Personal Capital’s more customized service is a downside to me even while it is a plus for others.

Kate January 16, 2016, 9:16 am

Whoa whoa whoa. You started with $100,000, invested a further $12,000 total with your monthly buys and some additional amount of dividends, and ended up with $112,661. It seems like you only made $661- or even less given the dividends you invested. What am I missing here?

Mr. Money Mustache January 16, 2016, 11:50 am

Hi Kate, what you’re missing is that Betterment is simply an efficient way to invest in the world’s businesses through stock market index funds. In the year since I started this experiment, markets have gone sideways (and more recently down). This is totally normal over a short time period – stock investing is bumpy ride in the short term, but the world’s most powerful wealth creator over multiple decades.

Brendan January 17, 2016, 2:37 pm

Kate,

Pick a benchmark for your allocation and compare against that. MMM’s betterment account did better than my self managed account last year. I lost money, but was happy with the performance. Why you ask. Because my account is 70%/30% stocks/bonds with 30% of my stocks international. My benchmarks lost a little more than me so I did well. I will not change my allocation because there was a reason I chose it, and yearly performance goes not change that.

JN2 January 19, 2016, 12:50 pm

Thanks for the update! So you now have invested $115k total? A couple of extra columns would be great:

1. total invested

2. overall return

Email me if you’d like me to do it for you!

John

JN2 January 20, 2016, 9:15 am

I calculated the IRR/CAGR for the 3 scenarios, Betterment, VTI and VXUS:

approx -6%, -1% and -13% respectively.

Using the same CAGRs and withdrawing at 4% ($333/mth) gives ending balances of:

approx $88k, $94k and $79k respectively.

So, a 20+% loss of capital in 15 months (for VXUS)? Ouch!

Spreadsheet: https://docs.google.com/spreadsheets/d/1uLU_80PcC8WiALcHI0wSBTScwgzvxNdAI86-h8UCvjg/edit?usp=sharing

Jordan January 22, 2016, 11:24 am

Hey guys,

I currently have about $80 in market investments through USAA and am in the process of transferring them to Vanguard. I will admit that I have not been paying much attention to how they were invested until now. I have about $36K in VOO, $38K in VTI, and about $6K in cash. What are the advantages and disadvantages of holding these funds in ETFs versus in Index funds directly? I am reluctant to sell since my husband and I are likely to be in the 28% tax bracket again this year and do not want to pay capital gains taxes. My inclination is to hold on to these ETFs but diversify in the future by buying VFWAX and VEMAX to diversify my holdings outside the US.

Dōitashimashite January 26, 2016, 9:01 pm

Hello Jordon,

I’m at USAA myself, it’s a perfectly fine brokerage.

“What are the advantages and disadvantages of holding these funds in ETFs versus in Index funds directly?”

Basically ETFs tend to have lower annual fees, but sometimes a trading cost to buy and sell. Mutual funds (which Index funds are) may have higher fees, but no trading cost. So if you are investing small amounts regularly, you should look at index funds. If you are investing a large lump sum, ETFs might be better.

Of course, these depend on your personal situation. There are brokerages (like TD Ameritrade, another one I’m at) that don’t charge trading fees for some ETFs, so that’s a clear winner.

Yes, you are right, the taxes are probably not worth selling the funds. Just have the dividends and capital payouts NOT reinvested, but put into your new funds.

Certainly do your own math, but hope this helps!

Preston January 26, 2016, 2:49 pm

Great update MMM! After reading your initial Betterment post, I decided to experiment with Betterment as well with $200 auto-deposited monthly. I’m going to hold off for a few more months before taking the “full plunge” but I think I’m going to switch my primary Edward Jones managed account to Betterment. The only benefit I see from someone like my Edward Jones guy is that he can talk “the average Joe” off the cliff as the markets drop. Since I’m 26, I look at investing long term and would never jump ship anyway, thus I think I should avoid the fees and make the switch. Do y’all agree that this is the wise choice?

Lance February 6, 2016, 3:56 pm

I’m thinking about joining Betterment myself and really appreciate the MMM review of the website and performance comparison to date. I think an even better comparison would be to have added the recommended Betterment mix of stocks / bonds so that we could have an idea of how the website would have performed if not for your override mix of 90/10. I also agree with the JN2 posting that adding a couple of additional columns showing total $ invested along with overall return % would be helpful.

JJ February 14, 2016, 1:02 pm

Is my calculation correct to assume that your $115,000.00 total investment is now worth, as of January 18, 2016, $107,017.97?

Mark February 23, 2016, 11:44 am

As a total investment dummy:

1. Should one use his local country investment platforms?

2. Should one invest mainly in his local country stocks?

Cheers,

Mark.

Dōitashimashite March 1, 2016, 7:08 am

Actually a complicated issue, but there are reasons pro and con.

1. While it is possible to set up brokerage accounts in foreign countries, the currency, tax, and legal issues can be big. As a “total investment dummy” I suggest you don’t wade into these problems. Yes, use local investment platforms.

2. Pros — possible patriotism, self-knowledge, awareness of local industries, anti-globalization sympathy

Cons — possible lack of diversity, limited investment opportunities, pro-internationalization sympathy.

As a US investor, one does not have to stretch to get international benefits. Leading US companies are international, with manufacturing all over the globe and customer awareness near universal.

Are your country’s leading companies the same? If not, you may be missing out.

For example, Vanguard’s Total World Stock ETF (ticker: VT) indicates that 55% of all stocks are for North American companies. (I’m assuming Mexico and Canada are in there.) 22% are European, and 14% are Pacific (Japan, Korea, China, etc.) The other 9% are Middle East and Emerging Market (likely Africa, India, and South America)

Clearly, if you are from, say, Peru, you may do great just investing in Peruvian shares, but you will not have much diversity.

porkisking March 1, 2016, 10:21 am

MMM- For fairness, you should also add a line on the graph if you had done your own TLH which is straightforward with just VTI. Giving kodos to Betterment for automatic TLH is great, but you should compare that with your manual TLH that you would do annually or quarterly for an apples to apples comparison.

Mr. Money Mustache March 1, 2016, 4:47 pm

Good idea, Pork.. but I’m not sure if I would have been able to do ANY of this tax loss harvesting. Betterment catches these fluctuations right in the middle of the action on volatile days. I guess I could have a substitute for VTI (fund name suggestion?) and sell it quarterly if it happened to be down. You’d have to wait for funds to clear from the first sale and then be uninvested for a short time before grabbing the new stuff.

As far as I can tell so far, TLH is a game best played by computers.

porkisking March 2, 2016, 3:36 pm

MMM- Are you harvesting gains in your retirement? If so, you should be able to do TLH since you’re changing your cost basis. VV tracks VTI reasonably well for TLH.

Mike March 2, 2016, 9:14 am

Will the fees from Betterment still be worth the benefit of tax loss harvesting (TLH+) after you’ve accumulated over $1 million? At 0.15%, that accounts for ~$1,500 per year, which is ~3.75% of a $40,000 per year withdrawal. Not to mention the additional expense ratio from each ETF.

In other words, is there a point where Betterments fees negatively impact the benefit of TLH+?

Jose March 9, 2016, 9:30 am

Hi MMM and group —

Here is my situation and I appreciate any advice. I’m in my late 30s and have a little over 400K invested with a major financial firm (MFF), 30K with lending club, and some other money in a 529, individual stocks, etc.

When I was younger, I handled all of my investments myself and mainly invested with Vanguard. About 8 years ago, I started making a decent amount of money and didn’t have time to deal with it. So I went with a financial adviser recommended by a friend. I’ve questioned what he’s been doing a couple of times but overall my returns have been pretty good and he has had some good advice. Given the amount of money I now have invested in his MFF, he wants to start converting some funds to a managed investment at 1.3% (with potential other fees adding up to .6%). Some of the funds that will convert are front loaded funds, so I’ll basically be losing my up-front payment. Now I question his decision to use those funds to begin with.

I’m thinking about just getting rid of him completely. The fees could be reasonable at some point. But now that technology can basically replace him, it seems unnecessary. I don’t know if I should just drop everything into Betterment or Vanguard or some combination.

Thoughts?

Moneycle March 9, 2016, 10:13 pm

Those fees sound terrible to me. You’d be better off sticking all your money into a Vanguard Target Retirement fund and avoiding the fees. It sounds like your advisor doesn’t have a fiduciary responsibility (fiduciary means they have to do what’s best for you).

Matt March 10, 2016, 7:04 am

Yeah… 2% annual fee? NO THANKS. Say goodbye to 2% of your investment returns forever if you choose to go that route.

I would definitely suggest betterment, which is perfect for the set-it-and-forget-it investor. Low fees, automatic everything, TLH, Vanguard funds, great interface, etc.

TheBusThinker March 30, 2016, 7:40 am

Jose, look at it this way. The Vanguard 2045 target retirement fund charges 0.16% in fees. I’m assuming your guy will charge 1.9% annually if it’s already out there as an option. If you took your $400,000 and invested with your guy and didn’t add anything more, assuming he was able to get you an 8% annual return, your guy would have “gotten you” $972,000. If you put the $400k in the Vanguard 2045 target fund, assuming that same 8% return, you would end up with $1,240,000. A difference of $268,000 over 15 years for what??. Never pay the fees!

Michael L. March 28, 2016, 12:39 pm

Hi MMM, long time reader here, I was wondering if you think it would be a good idea for me to switch my allocations of my 403b. Just started saving a little over a year ago and have roughly a little over 3k in there right now.

I’m thinking of switching from:

100% Vanguard Institutional Target Retirement 2055 Institutional

To this:

50% Vanguard Total International Stock Index Fund Institutional

50% Vanguard Total Stock Market Index Fund Institutional

I am currently 27 years old, so I have a long ways ahead of me and thought an aggressive approach could work in my early years, adding in bonds later in life.

Moneycle March 29, 2016, 3:50 pm

Michael, I don’t know if MMM will respond but my opinion is to stick with the TR 2055 fund. It’s easy and is already aggressively invested with 90% stocks and 10% bonds and will stay that way for the next 14 years. After that (2030) it gradually becomes more conservative.

I like the 10% bond allocation because it acts as a shock absorber. When stocks go down, bonds will be sold to buy more stocks to keep the allocation at 90/10, and vice versa. The 90% stock allocation of the Target Retirement funds is 60/40 domestic/international. If you want to DIY, I would suggest a little less international exposure but that’s just one man’s opinion.

The bottom line is, either of your suggested allocations is fine. I personally err on the side of the simpler solution.

Alex March 31, 2016, 4:01 pm

Hey MMM,

I am not sure if this has been covered elsewhere but many of your readers could implement a simple tax loss harvesting scheme themselves. As an example, if one was always buying VTI regularly and a deep dip was to present itself (February this year) you could sell the highest cost basis shares (set the selling order on your broker to Highest Cost First). With a little analysis you could figure out the number of shares you have to sell at a loss and sell them all and buy 80% VOO and 20% VXF to buy them all* back.

Granted you would wash sale a few of the most recent buys (past 31 days), but that “loss” would be added to your future cost basis. Using this tactic you could have easily tax loss harvested in February to cover all your regular buys from mid 2014. If you are contributing as much as an average Mushtacian this could be significant.

* VTI is roughly equivalent to 80% VOO and 20% VXF.

What do you think?

mikey g April 19, 2016, 10:34 am

Seeing good discussion on taxable accts in Vanguard vs Betterment, and I see a couple separate issues. Assuming for the moment that the cost/benefit of tax lost harvesting (TLH) balances out with the fee premium of using Betterment; it seems to me that the diversification strategy is more effective and efficient than any park-it-and-leave-it strategy at Vanguard directly. I’ve in fact been doing that, but because for one reason or the other I’ve been shuffling money around in different funds, I gotta wonder if it’s not in fact a big advantage of adjusting allocations using Betterment to shield against unintended tax consequences that you’d need a spreadsheet and your Vanguard purchase history handy to find the right strategy.

In other words, unless you know exactly what allocation (stocks to bonds) AND exact funds/ETFs you want indefinitely, it seems that the robo-advisor would more effectively allow you to tweak this than any Target Retirement or other set of various funds could. Not to mention optimizing specific funds for taxable accounts. Thoughts?

Rowboat May 20, 2016, 11:34 pm

Great thread, super super helpful, thank you MMM and everyone. I have about $3M in various accounts with Schwab and while the majority of that is in VTTHX (one of Vanguard low-cost blended target-date funds-of-funds), I am considering Schwab Intelligent Portfolios. SIP seems attractive because it’s perhaps more diversified than funds-of-funds like VTTHX or Vanguard LifeStrategy (true?), tax-loss harvesting is free (for accounts over $50K), and, well, it’s Schwab, which has less of a chance of disappearing than a startup like WiseBanyan.

My main question is that I see widespread criticism of SIP for allocating 5-15% of investor portfolios to cash, and the suspicion that they are “making money” on the interest on this cash. Isn’t it prudent to hold this much cash anyhow? And if so, you have to hold it somewhere, and whichever bank you have it in is going to make interest in that cash. Some people also point out that holding X% cash is a “drag on earnings”. Well, yes, but again, you should hold some cash regardless of who/where you invest with, so this is a non-issue. I think it makes sense for Schwab to recommend that investors hold some cash. I think this criticism is overstated and basically not an issue.

I would love to hear your thoughts on Schwab Intelligent Portfolios, the cash-on-hand issue, and SIP vs Vanguard blended/LifeStrategy funds.

Thanks!

Nick July 23, 2016, 2:10 am

HI all,

been enjoying reading all the comments, some very good info here. I have been using Wealthfront myself for about 6 months now, using the free under $15k. However, I am about to start adding more money and auto deposits, just not sure what to do. I could setup both betterment and wealthfront, but vanguard for both would overlap?

I cannot put money into IRA (make over the limit), I am putting money into employer 401k, pre tax and Roth, 50/50, 5% into each, but I am only getting about 2% return on that account. My employer just does a flat contribution based off percentage of salary, then some Profit sharing as well. So no matching, so only real benefit is its pre taxes.

thought about multiple accounts, but vanguard, betterment, wealthfront, they are all similar with many vanguard.

Any thoughts what to do?

Daniel July 27, 2016, 9:47 am

MMM,

Have you ever written an article comparing Wealthfront vs Betterment? If not, what do you think are the main differences and how can i decide which one to use?

Dan

Nice joy September 10, 2016, 6:26 pm

Charles Schwab offer free investing platform but it mandate you to have a cash allocation. This cash allocation can cost you more than Betterment fees.

http://www.thelifebubbles.com/?p=35

Scott September 30, 2016, 8:05 am

Hey all, since this is my number one source of Betterment VS Vanguard/lazy portfolio type of investing, what are thoughts on the new tax-coordinated portfolio by Betterment? Does this make Betterment’s fees more worth it?

https://www.betterment.com/resources/inside-betterment/product-news/introducing-tax-coordinated-portfolio/

Keirnan October 3, 2016, 9:02 am

A picture tells a thousand words. I like your graph. Is there a reasonably accurate (not necessarily precise) way of building a benchmark to compare to the Betterment account. Maybe 10% Bond ETF, 70% VTI and 20% VXUS?

I notice that Betterment’s pitch is to compare themselves to other advisers which makes sense in many cases, but in the “should I just buy 10/70/20 directly and just let it roll” v Betterment argument I am finding it hard to get the numbers and present it to my domestic investment committee. We are just looking at what if I invest $100K with no monthly top-ups scenario.

BobH October 20, 2016, 2:57 pm

What are your thoughts on thier new tax coordinated portfolio?

Mr. Money Mustache October 20, 2016, 8:11 pm

It looks great to me so far – I have a few outstanding questions with their development team before I press the button on my own account (and maybe write a new article about it, since the savings are pretty easy and significant).

Ben November 2, 2016, 3:20 pm

Hey Mr Money Mustache. Thanks for laying this all out.

Since you own Vanguard Funds that track the same or similar indexes as Betterment does, do you run the risk of wash sales because of their TLH feature? Are you worried about this?

Also, if a wash sale occurs what are the consequences?

Thanks