For a little over ten years, I have been contributing to an automated stock investing account, choosing Betterment out of a large and growing field of companies (affectionately referred to as Robo Advisers) that offer similar services.

See Article: Why I Put My Last $100,000 into Betterment

On this page, I’ll keep you up to date with quarterly results, and we’ll also learn more about how Betterment works, and investing in general.

Show Me The Money!

(results as of May 2025 – including dividend reinvestment and after fees)

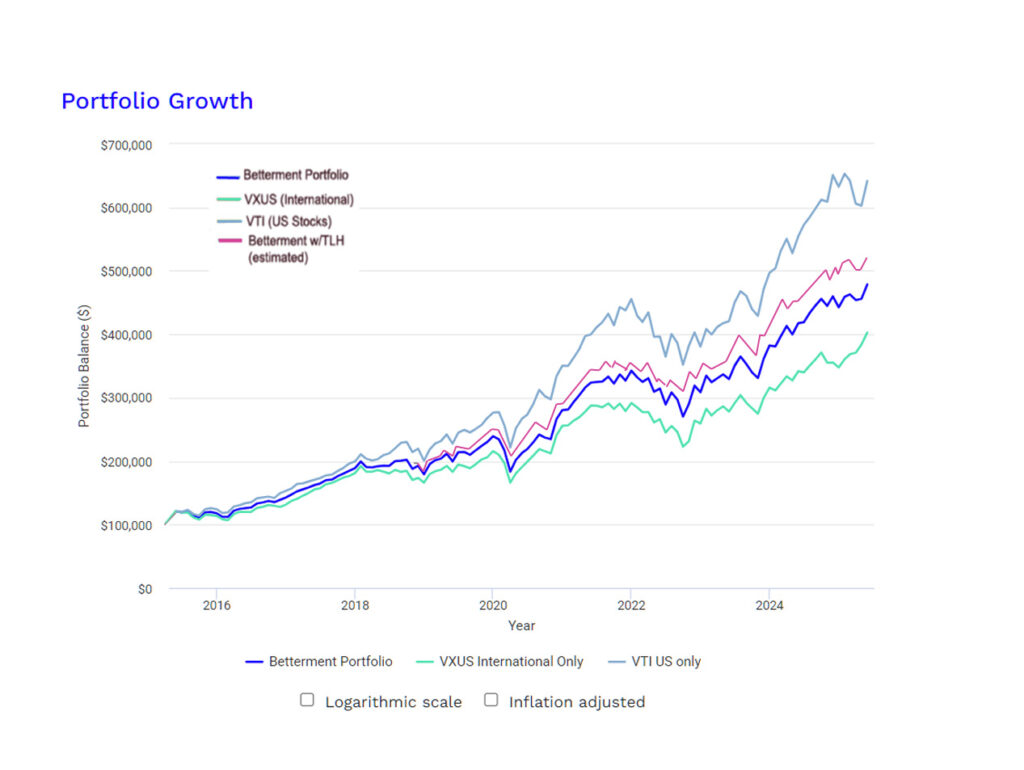

The blue line in this handy graph shows the results of my real investment at Betterment. I started with $100,000*, and am allowing them to suck in and auto-invest another $1000 from my bank account every month as well as reinvest all dividends, to simulate a pretty typical scenario.

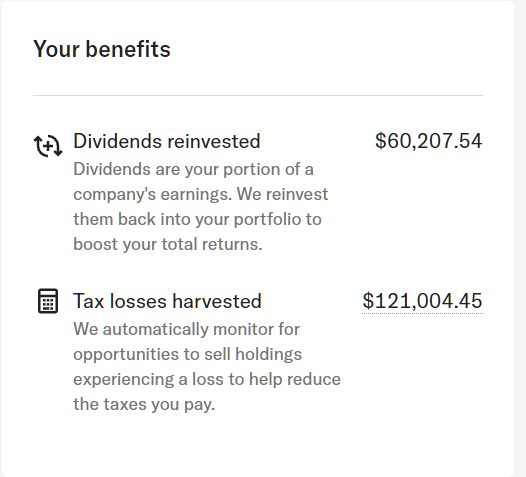

The purple line is my best estimate of my own benefits from Betterment’s tax loss harvesting feature. That depends on your own individual tax situation, but so far I have seen over $121,000 of “tax losses” harvested from this account, which at a marginal tax rate of 40% (state+federal) has added over $48,000 of benefit to my account value which compounds over time (see below), which would bring that line much closer to the top.

The top (grey) line is what would have happened if I had followed the same investment pattern with entirely US stocks through Vanguard’s excellent VTI Exchange-traded fund, and the bottom line is the same scenario if I had bought Vanguard’s equally excellent “Everything Except the US” fund, which goes by the ticker symbol VXUS.

This should help put the 2018, 2020 and 2022-2023 market declines into perspective, which all generated a lot of scary headlines in the financial papers involving the words “plunge” and “worst ever”. This is because newspapers make money off of scaring you, while in fact there is nothing scary at all about a buy-and-hold index fund investment.

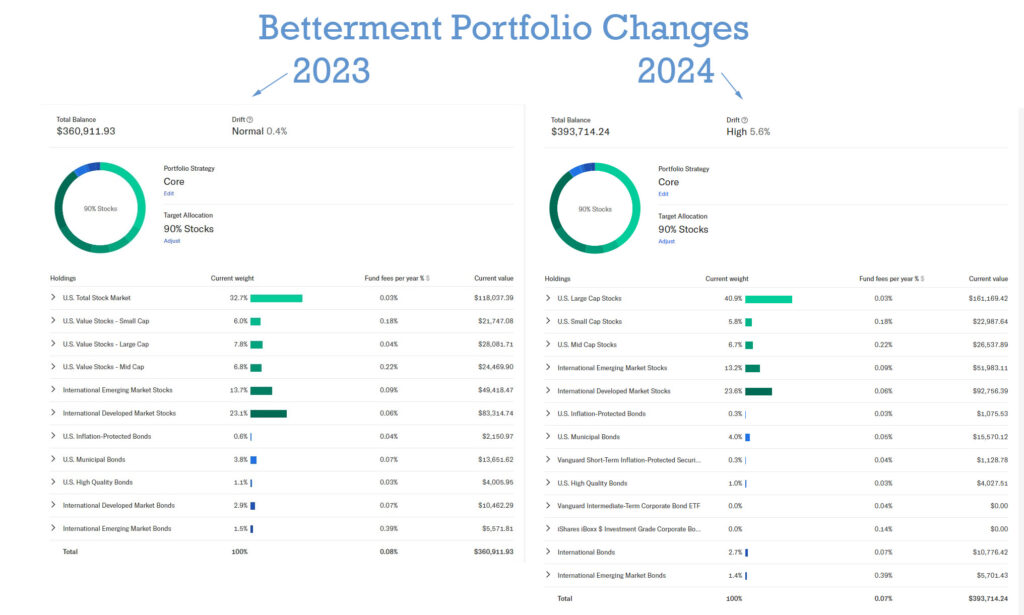

New in 2024: Betterment (slightly) Tweaks the Portfolio

Over these first ten years, the Betterment portfolio has fought an interesting battle: US mega cap stocks (like Apple and NVidia) have gone crazy and outperformed both the rest of our economy, and the rest of the world. Meanwhile, bonds have had a slow decade, due to low interest rates. This has handicapped the Betterment allocation relative to a hypothetical helping of purely US stocks. Fighting these macroeconomic trends on the positive side, Betterment’s tax loss harvesting and rebalancing has partially made up some of the difference (see below for details on that harvesting).

In January of 2024, Betterment made a slight change to their default portfolio, going a bit more all-in on the pure US index and reducing the “value tilt”. Here’s a screenshot of my account’s allocation before and after this change (click for full image):

I also spoke with some of Betterment’s investment management team after this change, who explained some of the other benefits of the new allocation. In short, not only does it bring the portfolio back into line with their original investing goals, but a drop in underlying fund expense ratios also allows for even better potential tax loss harvesting in the future.

Moving back to our regular programming, here’s my account’s performance since the beginning:

A recent screenshot of my “performance” tab. Note that I took out $95k for a charitable donation in late 2020, then replaced exactly the same number of shares when I had the cash in September 2021 (by that time the same shares cost me $135k – another great illustration of why you should always stay invested!)

Why do I think this is a good strategy?

In one word: Simplicity. OK, maybe we could add a second word to that: Efficiency.

After twelve years of writing this blog and hearing from readers of all types, I find that the same question keeps coming up: “What is the single step I can do to get started in investing?”

With no knowledge at all, most people default to keeping their money in a savings account where it will earn them nothing. Others resort to a Wild West financial adviser whose claims and fees exceed his actual financial knowledge. Or speculate in individual stocks and try to time the market. None of these approaches are winners over the long run.

To combat this, I’ve always said “Just buy the Vanguard Total Market Index fund (ticker symbol VTI).” That gives you a near-optimal ownership of hundreds of companies, in single giant, stable, low-fee fund run by an honest company. Over time, this single investment will outperform over 90% of financial advisers and other funds, while letting you sleep well at night.

To improve on VTI, you need to soak up a few more books about investing, general world finance, and asset allocation. And while this has always been my idea of a good time, I have learned that many people have other ideas for their weekends. And even those of us who read these investing books (myself included) often fail to execute the principles properly and consistently.

Betterment combines the (slight) advantages of more advanced investing, with an even simpler experience than you would get with just buying shares of VTI. The worthwhile things they provide, in my opinion, are:

- tax loss harvesting (see below)

- automatic tax-saving coordination between your standard and retirement accounts with Betterment

- really good tools to show you things like, “how much tax would I owe if I sold these shares right now?”, “how much income would my portfolio generate if I retired right now?”, and other useful visualizations

- a very sleek charitable giving system, which makes it easy to donate some of your appreciated shares – giving you a much bigger tax advantage than simply giving cash. More details on this in my 2017 charitable giving article.

In exchange, they charge a fee of 0.25% that is higher than just holding individual index funds, but much lower than standard financial advisors – and yet their investment methods are better than the average advisor, because many of them are commission-based, meaning they make money by steering you towards certain funds).

So in my view, Robo-advisors are a good way to invest for people who want things to run on autopilot.

Hey, my Betterment account [underperformed or overperformed] the US stock market! Why?

Welcome to your first two lessons on investing:

- Short-term fluctuations (under 10 years) mean almost nothing.

When investing for lifetime wealth, you need to think about longer time periods than you’re used to. It doesn’t matter what your stock does right after you buy it. What matters is the average price as you sell it off in increments much later in life – which could be 20-80 years from now. For example: Imagine that I went back in time to October 2014, but instead of getting started with Betterment, I bought $100,000 of stock in the video game company Electronic Arts (EA). As luck would have it, those shares would have closed out 2014 worth about $143,000. Does that mean EA is a better investment than VTI? No, it’s just more volatile. In fact, if you had bought EA in 2003 and walked away until December 2015, you would have earned zero returns for the entire twelve year period. The company has never even paid a dividend. Individual stocks are more volatile than the overall index, and yet collectively their returns equal that of the index. Which is a bad tradeoff in my opinion. - Your fancy new Betterment account contains more than just US stocks – over the long run this is a good thing!

The Vanguard fund VTI tracks the majority of US stocks. A Betterment portfolio tracks the majority of the developed world’s stocks. In recent years, the US S&P 500 index has been on a rampage, although mainly because of crazy overperformance of only the biggest and most heavily weighted stocks (Apple, Microsoft, Amazon, Google, Nvidia, Facebook, etc). And meanwhile, most European companies have seen solid earnings but lower stock price multiples. In other words, European stocks have been on sale. So my Betterment portfolio didn’t rise as quickly as the US market. At other times, the reverse happens: US stocks will fall dramatically, while other markets will fall less or even rise. On top of this, international stocks currently pay a much higher dividend yield. For every $100,000 of VTI you own, you’ll get about $1600 in annual dividends. For an equal amount of VXUS, you will get $2880, or almost twice as much. In other words, international stocks are priced at a much more attractive level than US stocks, which in my book is a time to buy.

How about that Tax Loss Harvesting?

One of the features of Betterment is that their computers spend all day looking at the stock market while you are off doing other things. Occasionally, this leads to an opportunity to profit from volatility in the market. Selling some of your stuff to lock in a tax-deductible loss, while buying very similar stuff through other funds so you remain fully invested.

Since I started this account, I have found that this feature works much better than I had expected. Take a look at this recent snapshot from my account :

Betterment has harvested a surprising $121,004 in deductible “losses” on an account with about $466k of taxable money in it.

The value of this is significant: a $121k deduction has saved me over $48,000 in income taxes already, which I have used to buy still more investments. If this $47,000 goes on to earn a conservative 7% ($3300/year), it is more than paying for the fees Betterment charges me (0.25% of $460,000 is over $1000 per year). Forever. And that’s just the passive income from these early years of tax loss harvesting. Then you also get to keep the principal you saved from the loss harvesting.

In other words, in my opinion Betterment costs less than nothing to use due to TLH alone, even before you factor in the benefits of the automatic reallocation, better interface, or other features.

The bottom line is that you save on taxes today but end up with investments which have a lower cost basis. This means you’ll have more taxable gains when you eventually sell them But for many of us, this is years down the road in retirement when we have ditched the full-time salary and thus are in a lower tax bracket.

How this works in practice: So when I file taxes for each year, I can take the Tax Loss Harvesting numbers from Betterment, and chop that amount off of any capital gains I made elsewhere that year. Sometimes those include profits from selling a rental house, or shares pf regular stocks that I sold to buy a new house, or up to $3000 against ordinary income. Betterment sends you a tax statement that you simply plug into your IRS tax forms, Turbo Tax, or hand to your accountant.

But this is not useful for everyone. For example:

- If you are using Betterment for an IRA rather than a taxable account, there is no such thing as Tax Loss Harvesting.

- If you are in a low income tax bracket right now, you might not have enough potential tax savings to make it worthwhile

- If your income ends up rising even after retirement (as has happened to me and many other early retirees), TLH might be counterproductive if you still have super-high income in the years that you are cashing out your Betterment account. (talk about Champagne Problems!)

- If you have other investments outside of Betterment with similar or identical funds, you might find the IRS disallows Betterment’s harvested losses. To prevent this, I hold different funds in my other accounts (I use Vanguard’s ESGV index fund instead of VTI – similar but different enough to avoid the risk of a wash sale)

Even with the caveats above, it is a cool enough feature – and profitable for many – that I left it enabled since the beginning.

This experiment remains interesting even after quite a few years, so I look forward to years of profits and analysis to come!

Note: To be clear on the background, I did not get paid to write this or any other post, but Betterment does advertise on this site. See the affiliates policy if you’re curious how I handle blog income.

* I chose an allocation of 90% stocks, 10% bonds, which you do by moving a simple slider control on the Betterment website as you set up your account.

Useful Resources:

The price and dividend payment history of VXUS and VTI, which I used to generate the spreadsheet to make the graph above:

http://www.nasdaq.com/symbol/vxus/historical

http://www.nasdaq.com/symbol/vti/historical

Portfolio Visualizer, a stock market analysis tool I really like, which I use to generate the comparison graph each time I update this article.

Jackie November 12, 2016, 6:56 am

Dear All,

I just found this website for the first time and its a real eye opener. The article is excellent. However, Im a bit confused about the allowable annual limits on tax-loss harvesting. I keep reading about a $3000 annual limit but MMM’s article says “a $23k deduction saves me over $7,000 in income taxes right now”. Can someone clarify the rules?

Jibba December 27, 2016, 9:48 pm

You can take $3,000 as a tax loss on this year’s tax bill against “earned income,” such as wages. So MMM could use only $3k of his $23k to offset earned income. However, he can use all of the losses at once to offset $23k of capital gains the investments may have created over the year (or to offset the sale of a home, stock options, etc). Any capital loses that are not used this year can be carried-forward to future years indefinitely. Effectively you can cash in your losses when it pleases you to do so, which is a handy tool to have in your tax-box.

The $7,000 income tax savings on $23,000 of tax loses indicates a marginal tax rate of 30.4%, which is likely 25% Federal, and 5.4% state. Bankrate shows Colorado as a flat 4.63% tax, but perhaps there is a local tax thrown on top. In Maryland where I live, the state tax is usually between 8-9%, so tax savings are a huge deal for getting your fair share of your earnings.

Jibba December 27, 2016, 9:58 pm

To clarify a bit more on the above, the $7k tax refund must be computed based on “earned income,” and so will need to be spread over a number of years to get that tax-benefit. If exercised in a single year (this year for instance), a $23,000 tax loss will lower only $3,000 of income ($930 tax refund), and $20,000 of capital gains at 15% Fed and 4.6% state (savings of $3,920 in capital gains taxes this year). So really a $23,000 tax loss can only amount to a bit less than $5,000 in tax savings this year. The only way it will be more is if he is in the 20% capital gains bracket (and add the ACA penalty), or that these are short-term capital gains, which are taxed at ordinary rates.

Minderpants November 18, 2016, 3:05 pm

Hi everyone and MMM! I’ve been spending the last year or so reading your blog from start to finish and am loving it.

There is probably a simple explanation to this that I can’t see yet, but how is Betterment better than just buying VTI? I ask, because it looks like you would have made an extra $10,000 if you had just invested in VTI, and you’d only have the one fee from the index fund to pay. With Betterment, you’re paying for their services plus the fees from whatever indexes they invest in, no?

Is it the money they saved you with the tax loss harvesting?

Eric November 22, 2016, 9:03 am

MMM,

What is holding you back from placing your entire nest egg in Betterment? Managing the wash sale rule, while also trying to diversify your assets outside of Betterment seems unnecessary if you believe in the Betterment approach and see a net benefit (eliminating time associated with DCA across ETFs every month, TLH, one-stop shop).

Struggling myself whether to put all my eggs in one basket, and seems like it should be an all or nothing approach. Thoughts?

Thanks,

Eric

zesty December 29, 2016, 12:18 am

Hi MMM, thanks so much for the great blog and your insights. In the post you mention: “If you have other investments outside of Betterment with similar or identical funds, you might find the IRS disallows Betterment’s harvested losses. I am in this boat, so I need to manually watch for “wash sales” and slightly decrease the deduction I take.”

I have a Fidelity 401k with biweekly contributions at my company and am considering opening a Betterment account for additional taxable investment money + my rollover 401k from previous employer. In the Fidelity account, I plan to have a mix of iShares Blackrock index funds, so I need to watch for a wash sale if I have TLH turned on with Betterment. I was just wondering about the mechanics of how you manually watch for wash sales and determine the amount to decrease your tax deduction, as mentioned above? For example, is there a statement you review at the end of the year from Betterment that allows you determine this easily? I’d like to utilize TLH, but other than using target date funds in my Fidelity account (which seems suboptimal), I’m not sure how to manually keep an eye out for a wash sale.

Thanks for any help you can provide!!

Christophe Gonzales Jr. January 21, 2017, 1:47 am

I’m on the same boat. How do we track wash sales manually?

Andrew January 3, 2017, 12:12 pm

MMM:

I’m curious if you still like Betterment for Roboadvisor? I have an account there but was also looking at the Schwab offering. I like the tax loss Harvesting I get at Betterment and am wondering if their is a way to compare the two?

Andrew January 12, 2017, 9:17 am

MMM:

I know you posted this a while ago but are you still a fan of your Betterment account?

Thanks,

Andrew

John January 18, 2017, 12:45 pm

So I finally finished reading this whole post and WOW, ton of information. For a little background I am 25 years old making about 75,000 per a year. My company does not match 401k so I just decided to open up a ROTH IRA with Scottrade. I wanted to invest in dividend paying stocks and spent the 5,500 (max to contribute per year) in dividend paying stocks.

After reading all these posts I feel I might have messed up using Scottrade for Roth IRA instead of Vanguard and

their index funds to pretty much let it ride until retirement.

Now my question is, should I switch brokerages and create a Roth IRA with Vanguard? Then create a individual brokerage with Scottrade where I can “play” with my money a little bit more buying different stocks, and be able to take it out when buying my first house and other expenses?

Jibba February 21, 2017, 12:57 pm

You can have as many IRA accounts as you like, as long as the annual contributions taken together add up to $5,500 or less. Go ahead and setup an account with Vanguard, but wait until next year to put money into it. I would keep your Scottrade account as-is. You did your homework and made your conviction investments. Study those companies and learn as much as you can about them and how markets work. Read the 10k’s. After a while you will find that there are companies you have more conviction in, and others that you could care less about. You may own both types. Then ditch the ones you don’t have conviction in, and double down on the ones you do. If you like Indexing and want to do that approach, do that too. I think everyone should own a few single company stocks so they can learn about investing, valuation, competition, products, strategies, and so on. You need to have some skin in the game to really learn. The bulk of your savings should be in funds, so that you achieve diversification. A simple total market index fund or SP500 fund is fine. Just focus on saving, and the investing will take care of itself.

Christian January 31, 2017, 7:52 am

I’m curious to hear thoughts on this old debate in light of Betterments recent fee changes – flattening from .35/.25/.15 on account balance to .25% across the board. I am pretty disappointed myself, but haven’t done the math just yet.

Zach February 17, 2017, 12:29 am

Hey MMM,

I enjoyed reading this post and look forward to reading more of your work. So, I wanted to get your advice for my situation. I have a Roth IRA through Thrivent Financial that I started fall/winter of 2015. From the little research I have done it sounds like their fees are too high. As a result, I am looking into moving it. So my questions are: 1. Should I move my Roth IRA to be managed by someone else? If so, what fees/penalties (if any) should I expect? And 2. If you think I should move it, where would you recommend a young investor transfer a Roth IRA to and why?

I am contributing $75/month at the current time. I could maybe bump it to $100/month if it helps cut down on fees significantly.

Thanks in advance for the insight!

Nil April 10, 2017, 5:22 pm

Hey there, thanks for this, I was looking for a comprehensible comparison for long term investing. I understand and agree that over 20 – 30 years passive investing is the best way go, nearly no active investors would beat the market over that time span.

I have a question regarding short term investing though (2 – 5 years). What is the advice / way to go in trying to invest a percentage of your money that you will have to use 2 – 5 years down the line? Someone mentioned being able to beat the market for short term investment or over a single economic cycle. What’s a reliable way to attempt to do that, which doesn’t involve a massive time commitment on your part?

Thanks for the advice :-) Cheers

Greg March 19, 2018, 9:24 pm

All this talk about fees for this, and fees for that. What about zero fees? As in M1 Finance? True, they do not ‘hold your hand’ but then the final decision of what to do is up to you anyway. Happy investing.

Shinn March 30, 2018, 7:37 am

Can someone explain why tax loss harvesting delays your capital gains? I am trying to run the math on that and I don’t get it.

Jess July 17, 2018, 7:10 pm

hi, Towards the beginning of the of the article you said that to improve on VTI you need to soak up a few more books. Is there a link on the most helpful books you would recommend. I’m 24. We Just wrote the last check for 34K of student loans, have 2 incomes, no kids and a low cost of living. We are sold on investing and ready to start. I’m still very torn on Investing directly with vanguard or going with betterment. Do you have any advice on how we should go about making our decision.

HS August 14, 2018, 4:41 pm

Hi Mr. Money Moustache,

I am sorry to be dense but I have read this post several times over the past few years (I’m not sure why I didn’t comment before now). Could you spell out the bottom line for me? Do you recommend Vanguard or Betterment? If Vanguard, what fund? If Betterment, what allocation of stocks/bonds? I really want to just set my money and forget about it but right now it’s not doing anything. This question is answered on other blogs but I trust you.

Thank you,

HS

SilentCogada September 18, 2018, 2:03 am

I kind of feel more informed, but more lost then before I read this. It seems like everyone has a different opinion. I would like to invest on my own, but I like the thought of Betterment. It’s kind of hard to read on what you need to do when theres so many ways to go and thoughts on whats best…. Especially when nobody is going to be in the same situation or goals. I wish there was data on people using Vanguard themselves vs Betterment. What the average gain was and what was the extremes…. kind of a risk reward and consistency evaluation.

Aaron October 8, 2018, 3:26 pm

Thanks so much for the article! So in today’s market (2018) since everything is up so much (stock market wise) is it still wise to dump say $100,000 into Betterment right now? Or should I wait until the market eventually crashes to invest it?

Granger October 16, 2018, 6:40 pm

Could you update the chart for this new quarter that just ended? Thanks!

Jerry Rehert October 18, 2018, 4:14 pm

Let me tell you why I just closed my Betterment account, transferring it to Vanguard.

I do a spreadsheet each month of all my accounts. Betterment routinely produces a Quarterly Statement. Each month when I don’t get an end of quarter statement, I either chat or email or call Betterment and request the “non-quarterly” statements, i.e. for Jan., Feb., Apr., May, Jul., Aug., Oct., and Nov. In the past this was never a problem. I would get the requested statement very quickly. When I requested the Aug. 2018 statement, I sent an email to support@betterment.com, as I’ve done numerous times in the past. I got no response. So I sent a second email – a third and a fourth email. Still no response. So I went on the website and found the direct phone line to Betterment support. I called. The answering machine put me on hold (with rather pleasant music, I must admit). However after some 20 or 30 minutes no one ever answered the line. I tried again with no success. So I went on the Vanguard site and got the paperwork for transferring an account to Vanguard. That’s my story. I was surprised but there’s only so much abuse I can take. Good luck to you all.

Sarah November 20, 2018, 9:03 am

Hey all,

I realize this is an older post but it’s been updated recently and figure it’s worth a shot to see if I get any suggestions..

Last February I moved my Roth IRA to Betterment after they pointed that I was paying a lot of high fees with my previous company. Over the past 9 months I have not seen a positive return percentage more than maybe 3 times and I’m currently at a -6.2% since moving the account… I’ve been getting antsy and really starting to consider moving my account back to my original investment group.

Any suggestions? Should I wait it out to see if Betterment starts making money vs losing it or should I go ahead and cut my losses and move back?

Mr. Money Mustache November 22, 2018, 3:02 pm

Hi Sarah – the key with any investment (as long as you are buying index low-fee index funds as you are doing here) is to set it and forget it.

Betterment is just a nice front-end for buying the entire world of stock index funds, and those just happen to have declined over the past year. It’s not Betterment’s fault, just as Betterment deserves no credit when markets go up in value.

If you’re saving for retirement, you can celebrate these lower prices, because it means you are getting more shares for your money as you continue to buy more of them.

Mike November 23, 2018, 10:00 am

What is your asset allocation? ie. what percentage do you have in each asset class — equities, bonds, fixed interest, real estate, cash/debt?

Eric February 13, 2019, 8:53 am

The world economy is in the dumps with too much debt. I moved my money out of Betterment after 3.5 years of poor results. I am much happier and profitable in Fidelity all USA stocks.

Eliza February 18, 2019, 4:58 pm

Hi everyone,

I’ve read The Simple Path to Wealth and am currently reading The Boglehead’s Guide to Investing. I have about 24K in a Roth with a brokerage firm through a family friend. I have about 14K worth of gains in that. I also inherited about 100K of separate equities (in another brokerage firm). I’ve had that for 15 years or more so the gains on that are large.

I like the idea of Vanguard, but I don’t know what I should do with my Roth? Life Strategy or Target Retirement Fund?

1. Are those IRA accounts? How does my Roth fit into that?

2. What if I don’t know when I want to retire? Can it be moved?

3. In these Lifestrategy and Target Retirement, are these funds or ETFs?

4. Does Vanguard offer some advice?

5. Bogleheads suggest your age be the percentage of your bonds in tax-advantaged. I am 43.

6. Does anyone know of anyone who can offer hourly fee advice that has this perspective or similar to Bogleheads?

Thank you!

Hannah February 24, 2019, 2:15 pm

Mr. Money Mustache, the $100k and each additional $10k investment that you put into Betterment were new money? I have a large chunk of investment in Vanguard taxable account, and it seemed like I should just keep it there rather than move them to Betterment, correct?

dan f February 25, 2019, 10:05 am

M-1 Finance is the new Betterment. I stumbled upon this great new product by reading the investing and asset allocation advice on the Paul Merriman Foundation website.

M-1 provides all of the regular re-balancing that Betterment does without any of the cost. Here’s how it works:

– You pick an asset allocation “pie” (with each slice of the pie representing a different stock or ETF);

– You set up a regular contribution schedule (just like with Betterment)

– Each time there is more than $10 of cash in your M-1 account (by reason of contributions, dividends, etc.) M-1 automatically applies that cash towards purchase of new securities and the purchase of securities is weighted so that each purchase goes towards a natural re-balancing (e.g., if you are underweight VOO, it buys more VOO as compared to other securities in your “pie”)

– Here’s the big advantage: There is no AUM fee! $0 fee. (This can save you hundreds or thousands per year!)

– There are no commissions / trading fees (just like Betterment)

How does M-1 make money?

– M-1 does make money on short-term cash float (they only trade securities once a day at 10am)

– They also engage in securities lending (but honestly this is not anything that other robo’s or broker/dealers are not doing; TD Ameritrade makes gobs of money by lending securities to Citadel the giant Chicago-based hedge fund).

Any other notes?

– Also, you can pick ANY stock or ETF you want. For professionals who work in Big 4 accounting firms with significant independence restrictions, this is a HUGE plus because I found myself fighting with Betterment over not putting me into certain securities. I had to leave them because they were so inflexible and I was at risk of independence violations.

– No tax loss harvesting but for no fee, I’m okay with that. Plus TLH lowers your basis and if you ever have to sell you end up paying the piper. There are downsides. Especially if you find yourself in a higher tax bracket later on in life.

jennifer March 4, 2019, 5:37 pm

Hello! I’ve had my Traditional IRA with Betterment for several years and want to transfer to Vanguard. Quite frankly, I knew almost nothing about investing when I opened it so it seemed like a good choice. I now feel like a know a bit more than nothing and would like to go the tried and true route of something like 80-90% VTSX and the rest in bonds for the long-term since that will give me a respectable amount of international exposure. Currently, Betterment has me owning 44% of my portfolio of developed and emerging international markets and the rewards have yet to reveal themselves, but the risks seem, well, risky. Not to mention the higher fees that Betterment charge over Vanguard. Are you still invested with Betterment?

Thank you,

Jennifer

M March 18, 2019, 12:34 pm

I am trying to set up a Roth-IRA on Vanguard and I don’t see simply VTI as an option – there are:

VTINX

VTIVX

VTIFX

VTIAX

Are these what you are speaking about? Am I missing something?

Thanks,

M

Mr. Money Mustache March 19, 2019, 8:51 am

Hello M! You are close. “VTSMX” and “VTSAX” are the traditional fund versions of VTI. VTI is the exchange-traded fund version, which means you can buy and sell it with any stock brokerage account, including the Vanguard stock brokerage.

In the future, for faster answers, try typing things like this into Google or your search engine of choice: “VTI vs VTIAX”, and so on.

nostache June 19, 2019, 8:35 am

We need to add a line to the graph for your contributions to compare the growth to inputs.

nostache June 19, 2019, 8:42 am

NVM, below is updated as well.

Glad to still see the experiment running!

Lisa M June 19, 2019, 11:32 pm

Is there a Canadian equivalent to Betterment?

Victoria June 25, 2019, 11:47 am

Wealthsimple is an option https://www.wealthsimple.com/en-ca/

James June 21, 2019, 9:13 am

Hi, when you started this, did you invest in the General Investing goal or the Retirement goal? I guess I don’t really see the difference, except the Retirement Goal keeps saying i’m way behind.

Brandon Lee Deriso June 21, 2019, 1:26 pm

Betterment now allows you to track external accounts, I wonder if they are able to procure enough info to avoid wash sale problems?

Jamie September 10, 2019, 7:26 pm

Hello MMM,

I read in the comments that Betterment charges you the regular rate of .15% however after signing up for Betterment and reading the terms it seems they will be charging me .25%. Also, being in the military my tax bracket is 12%, so Betterment recommends leaving the tax harvesting feature off. Would you still recommend Betterment under these circumstances? I appreciate the help.

brian January 15, 2020, 6:44 am

i am a us citizen living in japan but work for a us-based organization and have a us address. could i still use betterment?

Adam February 10, 2020, 3:48 pm

How’s this experiment going? Still interested, and keep coming back to this page!

Chad March 19, 2020, 12:06 pm

I might be missing something… but looking at your updated graph now in 2020 it seems pretty obvious VTI significantly outperformed Betterment even with their tax-loss harvesting. Or am I missing something?

Mr. Money Mustache March 19, 2020, 4:10 pm

You’re right – US-only stocks have appreciated faster than worldwide stocks over the period of this experiment, although it’s not a flaw of Betterment itself (During other time periods the opposite has been true).

However, I don’t include the benefits of tax loss harvesting in this graph, since that’s hard to account for due to different individual tax rates. Perhaps I could add a faint line representing my own results in that department – as of January 2020 you should add about $10,000 (my best estimate at my tax savings so far) to the blue line to account for that.

Rory May 14, 2020, 3:47 pm

Any update on your betterment account and how it faired during this recent downturn?

Brian May 15, 2020, 1:19 pm

MMM, I’m wondering if you could provide a data point on how Betterment performed during this recent Covid-19 market downturn and partial recovery. In my mind, the best use of something like Betterment (and diversification in general, really), is to try to avoid a black swan event at the worst possible time in an all stock account (ie, a few years before retirement).

Mr. Money Mustache May 15, 2020, 8:32 pm

Yeah, we are overdue! I will get on that on that very soon. The account has basically just tracked the stock market, except with a big bonus – HUGE Tax Loss Harvesting receipts, which will cut my tax bill yet again next year.

It’s amazing to me that the market can go down, and then back up again while I ignore it – and then I get a tax deduction just because it happened.

nostache October 15, 2020, 11:20 am

Assuming you have no capitol gains to offset those lossses, you are just end up building up losses to carry forward. Isn’t inflation just erroding those carried losses? (this is from a canadian tax perspective)

Mr. Money Mustache October 15, 2020, 4:11 pm

In the US, you can write off $3000 per year from your taxable income, which is pretty substantial/useful.

But in my case, I also usually have some additional capital gains that I can offset, at least every few years. These come up from things like selling a batch of shares in a taxable account, selling a house/investment property, etc. These have let me take advantage of all tax loss harvesting so far.

Sonia October 18, 2020, 10:29 pm

I am still trying to learn about tax loss harvesting. Are there any specific books/articles that are more recommended than others? Thank you!

Bliss88 August 9, 2020, 10:47 am

Hi Pete, I have $60K in a betterment IRA but $185K (self-managed, 90% VTI, 5% VXUS, 5% VNQ per Collins guidance)… would you say it’s better if I switched things around? Eg move the $60K IRA into Vanguard and the brokerage to Betterment? I started the experiment of Betterment vs Vanguard but missed your point of how betterment benefits TAXABLE accounts vs non-taxable. The hesitation I have is that when I transfer the IRA from Betterment to Vanguard, the assets will have to liquidate (no transfer of assets in-kind)… since the market is on an upswing, should I be concerned that I will “miss out” likely in the 1 week when the assets are not accessible?

Paul Michael Tidwell August 18, 2020, 10:37 pm

“To improve on VTI, you need to soak up a few more books about investing, general world finance, and asset allocation. And while this has always been my idea of a good time, I have learned that many people have other ideas for their weekends. And even those of us who read these investing books (myself included) often fail to execute the principles properly and consistently.”

I wouldn’t mind reading those books. What are the recs?

nostache October 15, 2020, 8:23 am

Time for an update?

Chris November 9, 2020, 1:47 pm

MMM,

Great article! I was curious about your Betterment 90/10, stock to bond allocation. How did you decide what’s best for you and what are your thoughts on their recommended allocations for different goals?

Thanks,

Chris

MrM1 November 11, 2020, 4:14 am

It’s Now late 2020. I have had small accounts at both Betterment, Wealthfront and an TD Ameritrade

– After a 2 year experiment between Betterment and Wealthfront they preformed almost the same, but I like the tools, layout and resources better at Wealthfront

BUT in the crash of Spring 2020 in Wealthfront, what can you do? I tried to run for cover as the market slide down. I set my risk score to .5 (the lowest) but that still left me in the market. I could find no way to just park it all as cash – So all I could do was watch it slide. At TD Ameritrade I was able to sell everything and just sit the dip out. I bought back in early June as the markets started rising again and at WF set my risk score back to 4.5. But at WF my balance really really dropped for a few months, even below principle. But I have recovered at WF even better.

Not saying Robos are good or bad. I just like having an option to convert it all to a cash account if I desire. What I do plan to do in 2021 is keep 10k at WF and mirror the Portfolio at TD with the larger investment. This way I have a “model” at WF, but can pull the money out of the market at TD Ameritrade. Obviously I lose some tax advantages, but I’m OK with that.

Mr. Money Mustache November 11, 2020, 7:27 am

M1 – I see the problem here: you are trying to be a stock trader, while these platforms are about long-term investing.

I would never try to predict the short-term fluctuations of the market, and sell out “before a crash” and buy back in “before the rebound”. Because much more often, you end up selling out and paying capital gains taxes, only to watch the market take off from under your feet and leave you behind forever. There are innumerable books and studies about why the math is strongly in favor of the long-term-accumulator, see A Simple Path to Wealth or some of the books recommended in this blog’s recommendations->books section.

Joe December 27, 2020, 7:44 pm

I invested in Betterment after reading this article and recently recommended Betterment to a family member. I was checking this article one year after my first time. I see it was updated with 2020 balance.

From what I understand, 100k grew to 240k in 6 years. That comes to CAGR of 7.1%.

Don’t you think it is almost half the return of S&P?

Am I missing something?

I moved my IRAs to betterment last year. I see returns on par with S&P.

Matt January 21, 2021, 8:50 am

One thing to note with Betterment is that they don’t play nice with other financial institutions. As I just learned the hard way, they don’t do “in-kind” custodial transfers. I’ve come a long way thanks to Mr. Money Mustache, and after a year and a half of Betterment’s automated help, I was ready for Vanguard.

So, I rolled my entire Roth, basically everything I have saved to retire from Betterment to Vanguard. I, of course, chose “in-kind” and was waiting for them to allocate my investments to what I had with Betterment. A month later the markets are all up and I have pile of cash in my Vanguard account. I thought it was taking a suspiciously long time to allocate it all, but when I called Vanguard they said that they were at the mercy of Betterment and that Betterment doesn’t do “in-kind” and instead sold everything and just sent Vanguard cash. So I missed the last three weeks of remarkable market gains, first while my money was in transit (in the ether between) and the last week due to my own stupidity… with it just sitting in my account as all cash. Ugh.

Now I don’t know when to invest it. Should I wait for the next 1-2% total market downturn, or just get in now? Any advice would be great.

Gopi Kuppan Thirumalai September 27, 2021, 10:21 am

I saved 30K.. what is the best way to invest that?

Vanguard MF or ETF.. I prefer less risk..

Mr. Money Mustache September 27, 2021, 10:39 am

Hi Gopi, the Mutual Fund and Exchange Traded Fund options are pretty much identical, so it doesn’t really matter.

Mutual fund: typically bought directly through an account you open directly at Vanguard

ETF: you can buy it through ANY brokerage (Schwab, Etrade, Interactive Brokers, OR confusingly enough, a Brokerage account from within your own Vanguard account)

I personally use only ETFs these days, because they let you buy and sell more quickly – handy for catching a fleeting dip in the market, and for getting your money out more quickly if you need it for something like buying a house.

Gopi September 27, 2021, 10:17 pm

Hi MMM,

Thank your for your reply. I understand your opinion and clarity provided.

SkyFIdive September 29, 2021, 2:33 pm

Adding my 2 cents here as I’ve been running my own comparison between Betterment and Wealthfront and you’ve commented on the relative strength of betterment’s technology. I think Wealthfront’s Daily Tax Loss Harvesting is superior… on $10,000 betterment has harvested $0 this year despite significant volatility in the S&P500 vs. ~$60 for wealthfront. Peanuts when compared to long-term market returns, but I seem to get better bang for my buck (25 basis points) with Wealthfront. Will be consolidating with them soon. TLH (when implemented well) is very valuable for young investors in the “build wealth” phase. Fully plan on transferring in-kind to fee-free Vanguard/Schwab when FIRE’d

SkyFIdive September 29, 2021, 2:38 pm

Wealthfront vs. Schwab: https://blog.wealthfront.com/tax-loss-harvesting-comparison/

Schwab’s pre-tax return was actually higher, but after-tax return is what really matters. Most telling is that for those investors interested in the automated-TLH benefit, schwab *says* they offer it, but don’t seem to act on it except probably in extreme cases (e.g. coronavirus downturn)

SkyFIdive September 29, 2021, 5:42 pm

Betterment doesn’t let you transfer taxable accounts out in kind… feels very underhanded. https://forum.mrmoneymustache.com/investor-alley/in-kind-asset-transfer-out-of-betterment-nightmare/

Stewart Cattroll October 21, 2021, 12:34 pm

Hello MMM,

Thank you for your ongoing updates on this experiment.

One question I have is to clarify what your current views are with respect to the allocation of investments in the US market versus international markets. For background, I am a Canadian and currently my RRSP is fully invested in the S&P 500 through VFV. However, I have been considering adding Vanguard index funds that track the Canadian and international markets into the mix (perhaps at an allocation of 50% S&P 500, 25% Canadian, 25% international developed markets) because the pandemic and other events over the last few years have made me more aware of the risk of black swan events that can radically change our societies and economies.

I invested 100% in the S&P 500 as a diligent reader of your blog after reading this classic post from 2011: https://www.mrmoneymustache.com/2011/05/18/how-to-make-money-in-the-stock-market/, in which you seem to endorse investing solely in the US market, as well as JL Collins’ series. However, in your ongoing updates on Betterment, you seem to suggest now that you believe in international diversification.

I was wondering if you could clarify your views on asset allocation across different geographic markets and, if they have changed, perhaps you may consider adding an update to your 2011 blog post for those just starting their journey through the blog?

I should add that investing solely in the S&P 500 has worked out great thus far, but of course past returns are not indicative of future results.

Many thanks as always for your excellent work.

Scott December 26, 2021, 3:44 pm

Hi MMM,

Thanks for the Dec 2021 update. I’ve been checking in periodically on this blog to see how your Betterment portfolio has been performing. Wealthfront now offers TLH as well, though they do it a bit differently. Are you familiar with their methodology and do you have an opinion?

Kevin February 14, 2022, 10:39 pm

Hey MMM,

I just wanted to let you know this post (the original one in 2015) is what got me into investing (with betterment and vanguard). I’m 29 now, a grad student, and full time worker. So the “hands off” approach helped me slowly dive in and keep a monthly auto deposit going for the last 7 years.

You inspired me to look towards early retirement (did not know that was a thing back then), and set me up to easily financially retire when I’m 36! My entire life plan changed when I found your website.

Thanks MMM.

Patrick December 16, 2024, 7:09 am

Sir, you realize this “robo advisor” has under performed the S&P 500 by nearly 5% annualized for the same time period? I’m not sure what your goals are but if you fall into the “FIRE” crowd, you’ll be retiring much LESS early than you would had you just went straight SPY. And you paid them for this.

Kevin December 22, 2024, 9:13 am

MMM- Whatare your thoughts on using Vanguard’s own Robo-Advisor, rather than a service like Betterment?